HSBC to acquire L&T Investment Management

By MYBRANDBOOK

HSBC Holdings Plc is said to buy the investment management unit of India’s L&T Finance Holdings Ltd.

The buyout is seen as the latest push to build up the Asian wealth and investment business that is at the forefront of the bank’s turnaround plans.

The London-headquartered lender said it had agreed terms to acquire L&T Investment Management, which had looked destined to be bought by Blackstone Inc. after the US fund management group was reported to be exploring a bid.

“This transaction enhances the strength of our business in India and reinforces our status as one of Asia’s leading wealth managers,” HSBC Chief Executive Officer Noel Quinn said in the statement. “This demonstrates our commitment to capturing the Asia wealth opportunity. We will continue to invest significantly to achieve that goal.”

The deal comes four months after HSBC agreed a deal to buy AXA Singapore for $575 million. HSBC has said it was looking to make three or four bolt-on acquisitions of around $500 million each.

LTIM had assets under management of $10.8 billion and over 2.4 million active accounts as of September, according to the statement. The proposed acquisition will be funded from existing resources.

India has become a key market for HSBC as it looks to expand its operations in Asia, which are already the mainstay of the bank's revenues and profits. Overall, India is one of the bank’s largest markets and its make just over $1 billion in the country in 2020, making it the lender’s third largest Asian profit center after Hong Kong and mainland China.

Surendra Rosha, co-chief executive Asia Pacific at HSBC, said the acquisition would provide the bank with “deeper access” to the Indian market. “India’s rising income levels and higher life expectancy are driving an expanding yet under-penetrated sector,” he said in a statement.

HSBC’s various wealth and asset management businesses managed $1.2 trillion on behalf of its clients at the end of the first half of 2021. This was up more than $200 billion year-on-year, reflecting growth in assets across all its units.

Google Pay has added "Open Wallet" shortcut

With the introduction of the "Open Wallet" shortcut, Google Pay has impro...

TRAI targets to finalise National Broadcast Policy by May-end

The Telecom Regulatory Authority of India will finalise the National Broa...

TAC Security becomes Cyber Security Assessor for the App Defen

The cybersecurity company, TAC Security has been selected as a key Cyber ...

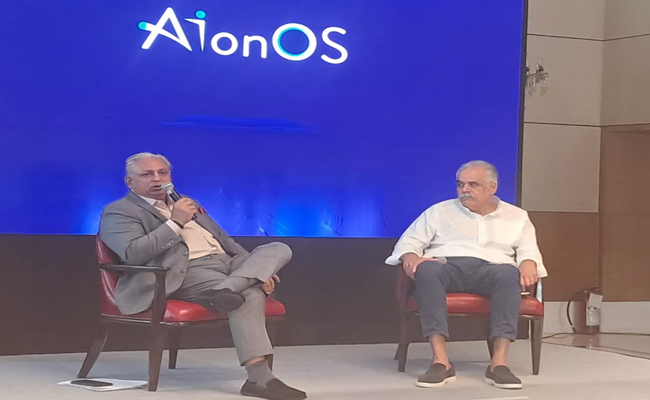

InterGlobe’s Rahul Bhatia and C.P. Gurnani together announce

In a move that is set to transform the AI landscape, Rahul Bhatia, Group M...

Technology Icons Of India 2023: Lt Gen (Dr.) Rajesh Pant (Retd.)

LT Gen(Dr.) Rajesh Panth (Retd.), National cyber security coordination...

Technology Icons Of India 2023: Nikhil Rathi

Nikhil Rathi, Co-founder & CEO of Web Werks, a global leader in Data C...

Technology Icons Of India 2023: Harsh Jain

Harsh Jain is an Indian Entrepreneur, the co-founder and CEO of the In...

New defence PSUs will help India become self-reliant

MIL, India’s biggest manufacturer and market leader is engaged in Pr...

TCIL continues to strengthen India with its technology expertise

TCIL undertakes consultancy & turnkey projects in the field of Telecom...

Leading company into fertilizers in the country

NFL is a dynamic organization committed to serve the farming community...

INFLOW TECHNOLOGIES PVT. LTD.

Inflow Technologies is a niche player in the IT Infrastructure Distrib...

FORTUNE MARKETING PVT. LTD.

Delhi based Fortune Marketing, An ISO 9001:2008 company, distributes ...

SONATA INFORMATION TECHNOLOGY LIMITED

Sonata Software Limited is a leading Modernization engineering company...