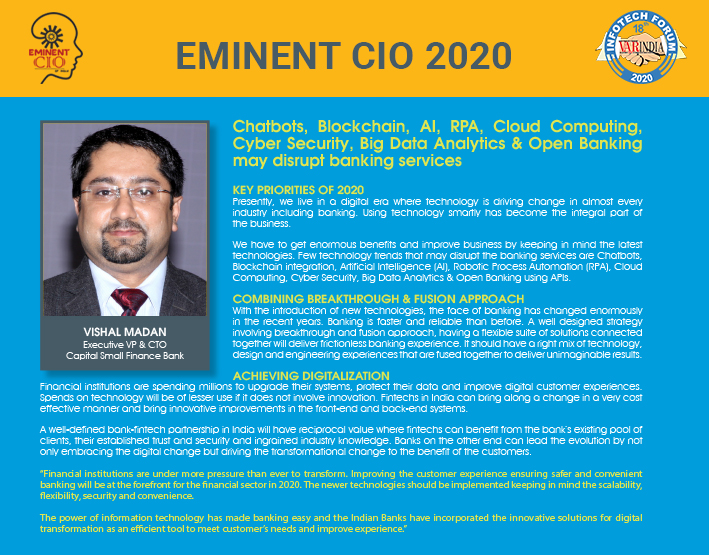

Chatbots, Blockchain, AI, RPA, Cloud Computing, Cyber Security, Big Data Analytics & Open Banking may disrupt banking services

By MYBRANDBOOK

Vishal Madan, Executive VP & CTO - Capital Small Finance Bank

Key Priorities of 2020

Presently, we live in a digital era where technology is driving change in almost every industry including banking. Using technology smartly has become the integral part of the business.

We have to get enormous benefits and improve business by keeping in mind the latest technologies. Few technology trends that may disrupt the banking services are Chatbots, Blockchain integration, Artificial Intelligence (AI), Robotic Process Automation (RPA), Cloud Computing, Cyber Security, Big Data Analytics & Open Banking using APIs.

Combining Breakthrough & Fusion approach

With the introduction of new technologies, the face of banking has changed enormously in the recent years. Banking is faster and reliable than before. A well designed strategy involving breakthrough and fusion approach, having a flexible suite of solutions connected together will deliver frictionless banking experience. It should have a right mix of technology, design and engineering experiences that are fused together to deliver unimaginable results.

Achieving Digitalization

Financial institutions are spending millions to upgrade their systems, protect their data and improve digital customer experiences. Spends on technology will be of lesser use if it does not involve innovation. Fintechs in India can bring along a change in a very cost effective manner and bring innovative improvements in the front-end and back-end systems.

A well-defined bank-fintech partnership in India will have reciprocal value where fintechs can benefit from the bank’s existing pool of clients, their established trust and security and ingrained industry knowledge. Banks on the other end can lead the evolution by not only embracing the digital change but driving the transformational change to the benefit of the customers.

“Financial institutions are under more pressure than ever to transform. Improving the customer experience ensuring safer and convenient banking will be at the forefront for the financial sector in 2020. The newer technologies should be implemented keeping in mind the scalability, flexibility, security and convenience.

The power of information technology has made banking easy and the Indian Banks have incorporated the innovative solutions for digital transformation as an efficient tool to meet customer’s needs and improve experience.”

InterGlobe’s Rahul Bhatia and C.P. Gurnani together announce

In a move that is set to transform the AI landscape, Rahul Bhatia, Group M...

Download masked Aadhaar to improve privacy

Download a masked Aadhaar from UIDAI to improve privacy. Select masking w...

Sterlite Technologies' Rs 145 crore claim against BSNL rejecte

An arbitrator has rejected broadband technology company Sterlite Technolog...

ID-REDACT® ensures full compliance with the DPDP Act for Indi

Data Safeguard India Pvt Ltd, a wholly-owned subsidiary of Data Safeguard ...

Technology Icons Of India 2023: Dr. Sanjay Bahl

Sanjay Bahl is currently with the Indian Computer Emergency Response T...

Technology Icons Of India 2023: Madhabi Puri Buch

Madhabi Puri Buch is the chairperson of the securities regulatory body...

Technology Icons Of India 2023: Bhavish Aggarwal

Ola CEO Bhavish Aggarwal had formed Ola-India’s largest mobility pla...

Leading company into fertilizers in the country

NFL is a dynamic organization committed to serve the farming community...

CSCs enabling rural India digitally empowered

Common service centres (CSCs) are digital access points under the Digi...

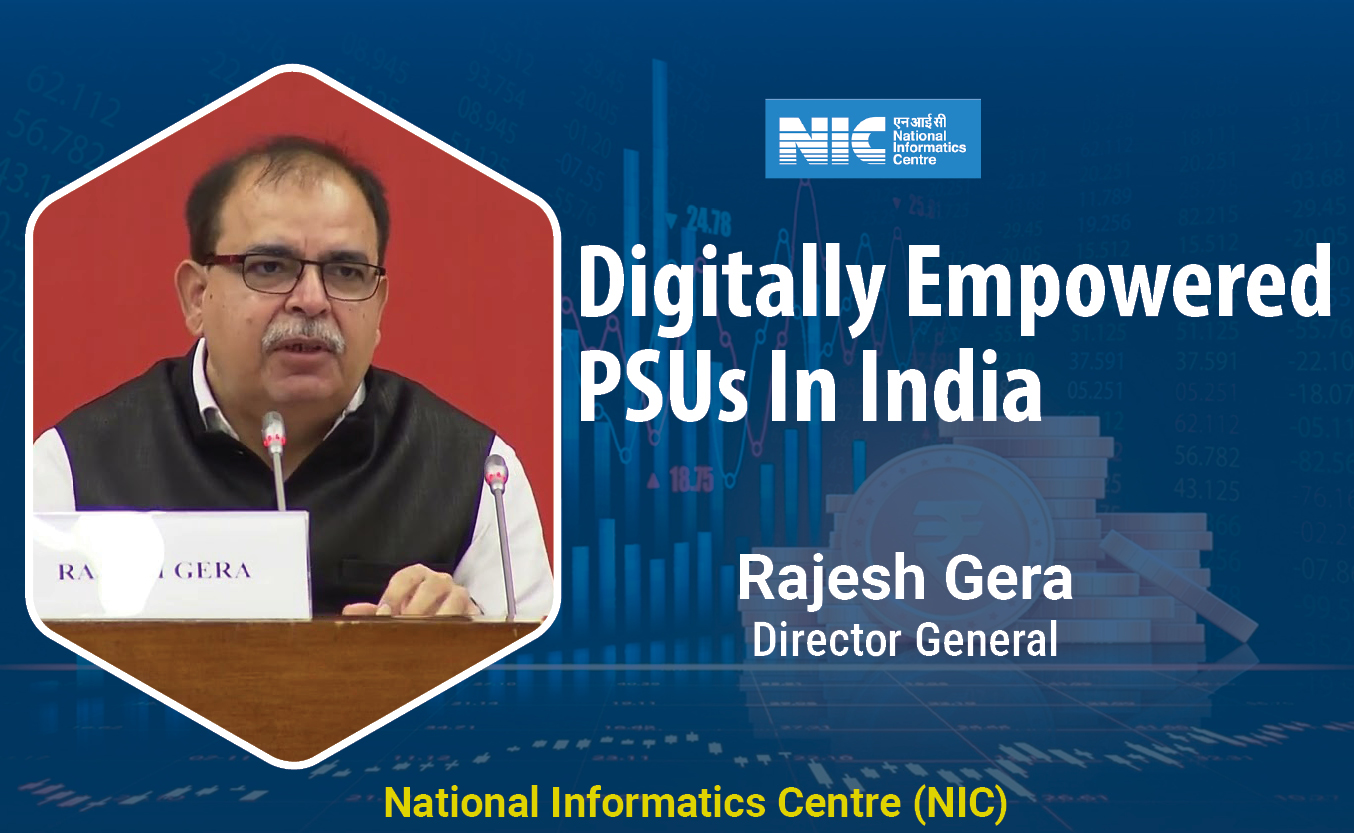

NIC bridging the digital divide and supporting government in eGovernance

The National Informatics Centre (NIC) is an Indian government departme...

M. TECH SOLUTIONS (I) PVT. LTD.

M.Tech is a leading cyber security and network performance solutions ...

EXCLUSIVE NETWORKS SALES INDIA PVT. LTD.

Exclusive Networks is a globally trusted cybersecurity specialist hel...

SUPERTRON ELECTRONICS PVT. LTD.

Supertron deals in servers, laptops, components, accessories and is a...