ATMs fraud: Nearly 74% Bank ATMs running on outdated

By MYBRANDBOOK

On Friday, the government woke up to the fact that as many as 74% of the cash dispensers are processing on outdated software and are prone to fraud and lack basic security features. The automated teller machines (ATMs) run by public sector banks may be easily accessible to frauds as they are running on outdated software by leaving it vulnerable to cyber attacks.The government, however, did not disclose details of such ATMs that were run by private sector lenders. Most ATMs in India are easy targets for Hackers & Malware Attacks.

A question arises on why do people wait for such attacks to happen to bring about a change? A huge number of machines in the country are operated by public sector players, with state run-banks controling close to 70% of the business, comprising of ending and deposits. The report says that close to 89% of the ATMs belong to this category, as told by the government in the parliament. The development came at a point when several ATM fraud incidents have been reported in different parts of the country.

Currently, India has over 2 lakh ATMs and approximately 70 per cent of them still run on Windows XP - which Microsoft itself stopped supporting in 2014. Most of the machines are running on Windows XP which cannot run many of the sophisticated security measures and many advanced security programmes cannot be loaded. Banks were going slow in upgrading the systems.

Since last few years, consumers have been complaining of the increase in ATM-related frauds, but it prompted the Reserve Bank of India only last month to issue a fresh advisory, asking banks to upgrade software in a time-bound manner and carefully monitor compliance. The RBI has asked banks to upgrade the operating systems and beef up security features in ATM machines with immediate effect to prevent frauds. Banks have to complete upgrades with the latest operating systems by June 2019. RBI further said that Banks have to submit a Board-approved compliance or an action plan detailing the implementation plan by July 31, 2018.

It is surprise to note as why banks were silent upto this time, when they have a dedicated IT and security team in place and have known about this fact. There are many banks that have created a 'Fraud budget'. When any cyber crime comes to their notice, they pay to the customer to fight the case and give money to the consultant and legal officers. Another question that remains unasnwered is how much money the banks have disbursed against this type of fraud.

The government informed Parliament that between July 2017 and June 2018 there were close to 25,000 complaints issued related to debit and credit cards, while the total number of transactions during this period was 861 crore, indicating that the number of frauds were few.

BHIM to join e-commerce, competing with PhonePe and Google Pay

The government-supported payment software BHIM is getting ready to join t...

The latest version of X helps prevent deepfakes on social medi

To combat deepfakes and shallowfakes, Elon Musk revealed a new update t...

India and Namibia collaborate on a payment system similar to U

Once operational, the platform will enable digital transactions in Namibia,...

Sebi issues show-cause notices to six Adani group firms

Sebi issued show-cause notices to six Adani Group firms, including Adani ...

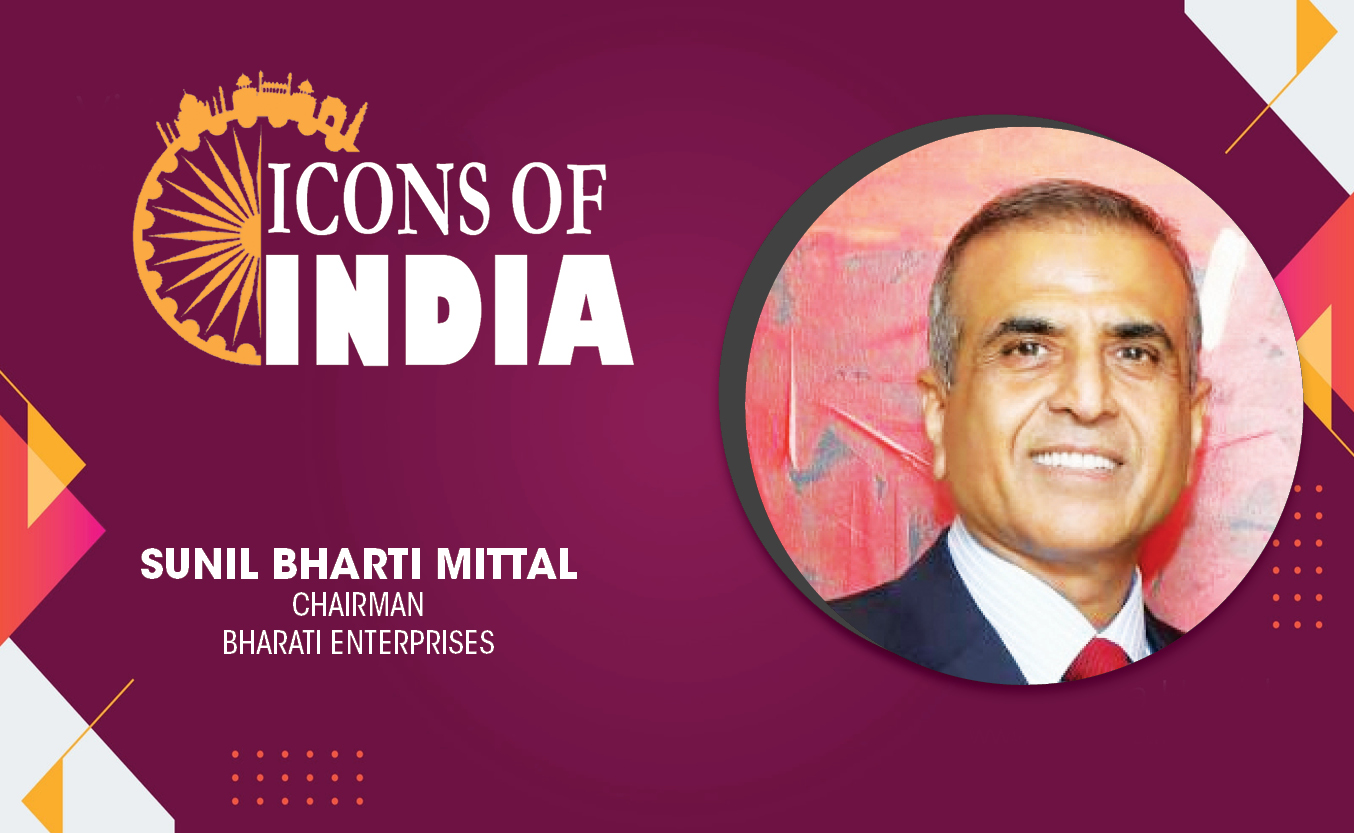

Technology Icons Of India 2023: Sunil Bharti Mittal

Sunil Bharti Mittal is the Founder and Chairman of Bharti Enterprises,...

Technology Icons Of India 2023: Bhavish Aggarwal

Ola CEO Bhavish Aggarwal had formed Ola-India’s largest mobility pla...

Technology Icons Of India 2023: Amitabh Kant

Amitabh Kant is presently the G20 Sherpa of India during its Presidenc...

Leading company into fertilizers in the country

NFL is a dynamic organization committed to serve the farming community...

TCIL continues to strengthen India with its technology expertise

TCIL undertakes consultancy & turnkey projects in the field of Telecom...

New defence PSUs will help India become self-reliant

MIL, India’s biggest manufacturer and market leader is engaged in Pr...

INGRAM MICRO INDIA PVT. LTD.

Ingram Micro India, a large national distributor offers a comprehensiv...

ADITYA INFOTECH LTD.

Aditya Infotech Ltd. (AIL) – the technology arm of Aditya Group, is ...

EXCLUSIVE NETWORKS SALES INDIA PVT. LTD.

Exclusive Networks is a globally trusted cybersecurity specialist hel...