RIL may raise Rs 10,000 crore from bond sale

By MYBRANDBOOK

Reliance Industries (RIL) along with banks is planning to raise ₹10,000 crore in a bond sale this week, equivalent to about a tenth of the special funding facility provided by the regulator, underscoring the possibility of top-rated and state-run companies picking up most of the amount.

The Reserve Bank of India (RBI) is lending as much as ₹1 lakh crore under Targeted Long Term Repo Operations (TLTRO) to lower yields in the secondary market and invest in primary issues. The move was announced on March 27 along with a cut in the policy rate to a record low as part of initiatives to help borrowers cope with the economic damage inflicted by the Covid-19 pandemic.

RIL is finalising details of the plan with Axis Bank, HDFC Bank, ICICI Bank and State Bank of India that could potentially feature the lowest cost of borrowing in years, said people familiar with the discussions. To be sure, the banks’ total subscription to the RIL bond sale need not necessarily be entirely from the TLTRO funds. RIL, ICICI Bank, HDFC Bank, SBI and SBI Caps did not reply to ET’s mailed queries. Axis Bank declined to comment.

Mid-sized corporates and non banking finance companies (NBFCs) fear that a substantial chunk will go to big companies and state-backed firms. With risk aversion at its peak, banks continue to shun small borrowers and lean toward triple-A-rated companies.

“Banks have a clear arbitrage here as they could park the money at least 260 basis points higher rate,” said Ajay Manglunia, managing director and head of fixed income at JM Financial.

"While the absence of mark-to-market obligation makes it more attractive for banks, corporations too avail cheaper money,” he concluded.

The spread or differential between the benchmark bond and top rated corporate papers narrowed to 80-90 basis points immediately after the March 27 emergency rate cut from 150-200 basis points. A basis point is 0.01 percentage point.

The domination of big firms and state-run companies may crowd out smaller borrowers.

“There is little chance of me getting funds from banks through this TLTRO,” said the chief executive of an NBFC. “If a PFC (Power Finance Corp) and I go for funds to a bank, it is obvious who the banker would prefer.”

The Reserve Bank of India conducted a third TLTRO on Thursday, when another Rs 25,000 crore entered the system. Lenders could raise money at just 4.40%. Banks are mandated to invest half of the sum from TLTRO in primary investment grade corporate bond sales.

"

BHIM to join e-commerce, competing with PhonePe and Google Pay

The government-supported payment software BHIM is getting ready to join t...

The latest version of X helps prevent deepfakes on social medi

To combat deepfakes and shallowfakes, Elon Musk revealed a new update t...

India and Namibia collaborate on a payment system similar to U

Once operational, the platform will enable digital transactions in Namibia,...

Sebi issues show-cause notices to six Adani group firms

Sebi issued show-cause notices to six Adani Group firms, including Adani ...

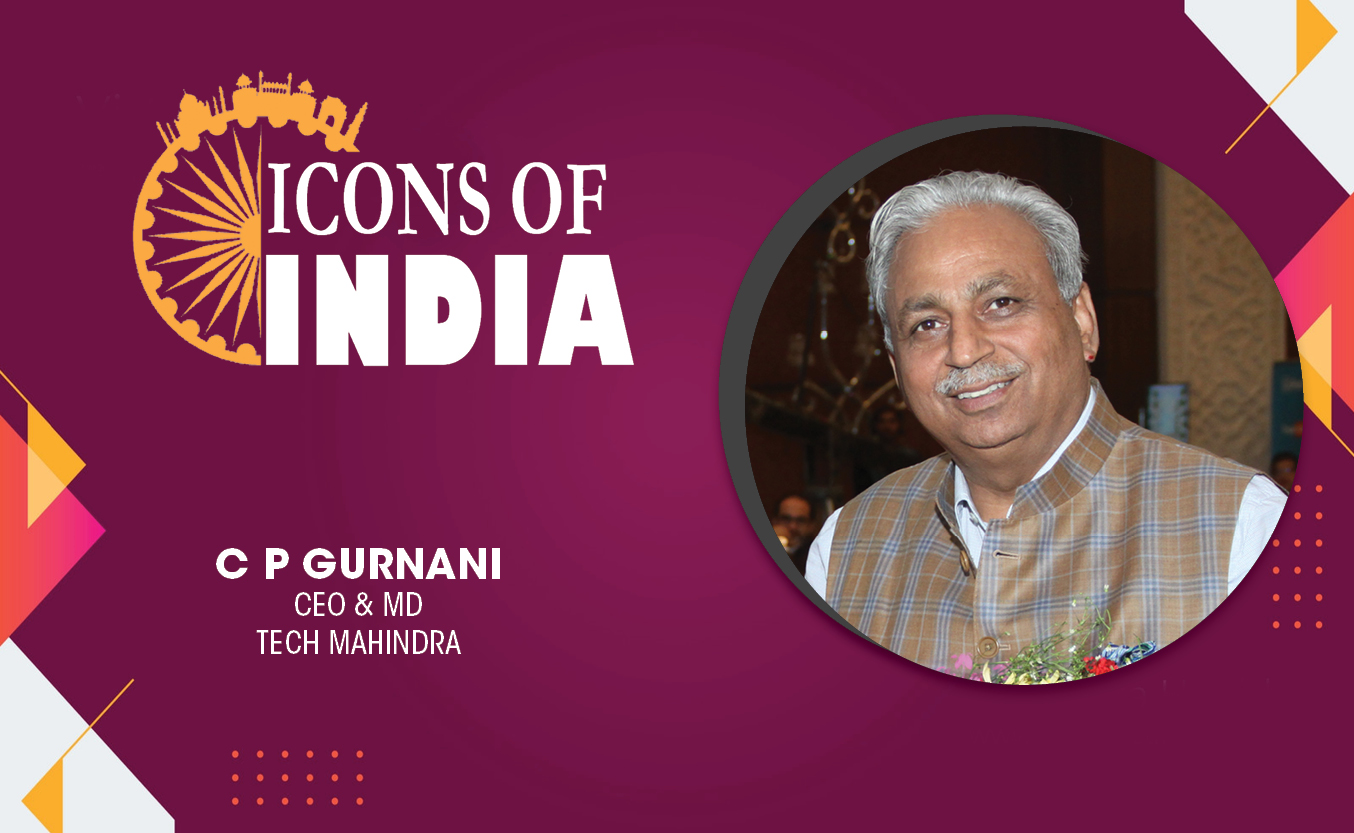

Technology Icons Of India 2023: C P Gurnani

CP Gurnani (popularly known as ‘CP’ within his peer group), is the...

Technology Icons Of India 2023: Anant Maheshwari

As President of Microsoft India, he is responsible for Microsoft’s o...

Technology Icons Of India 2023: Debjani Ghosh

Debjani Ghosh is the first woman president of NASSCOM (the umbrella bo...

C-DAC keeps India ahead in IT & Electronics R&D space

Centre for Development of Advanced Computing (C-DAC) is the premier R&...

BBNL empowering rural India digitally

BBNL provide high speed digital connectivity to Rural India at afforda...

STPI encouraging software exports from India

Software Technology Parks of India (STPI) is an S&T organization under...

BEETEL TELETECH LTD.

: Beetel is one of the oldest and most reputed brands in the Industry,...

INFLOW TECHNOLOGIES PVT. LTD.

Inflow Technologies is a niche player in the IT Infrastructure Distrib...

TECHNOBIND SOLUTIONS PVT. LTD.

TechnoBind’s business model is focused on identifying and partnering...