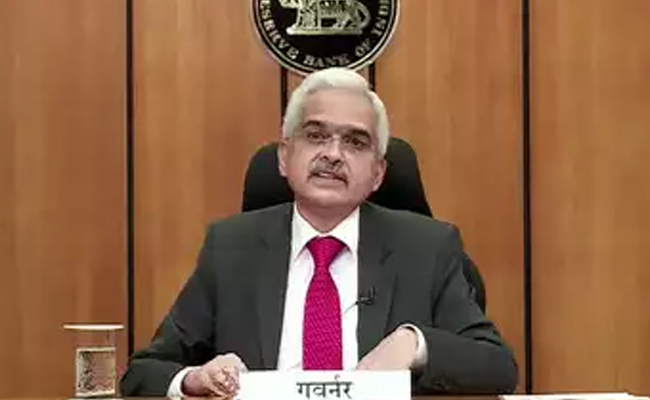

Shaktikanta Das reappointed as RBI Governor for three years

By MYBRANDBOOK

Shaktikanta Das, 64, has been reappointed as the governor of the Reserve Bank of India for a period of three years from December 20 or until further orders. On completion of the term, Das would become the longest-serving governor in almost seven decades and second-longest in RBI's history. The longer-than-expected tenure is seen by the markets as a message that the government wants to ensure continuity.

The tenure of Das was about to end on December 10 this year as the governor of RBI, when a Cabinet committee for appointments on Thursday approved his reappointment.

“The Appointments Committee of the Cabinet has approved the reappointment of Shri Shaktikanta Das, lAS Retd. (TN:80) as Governor, Reserve Bank of India for a period of three years beyond 10.12.2021 or until further orders, whichever is earlier," said a statement.

Shaktikanta Das is the 5th governor out of the 25 governors to get a tenure this long. Usually, RBI governors are given a five-year term.

Before him, Bimal Jalan served as RBI governor for six years, from November 1997 to September 2003. Other governors who served for six years were James Taylor (1937-1943), and CD Deshmukh (August 1943-June 1949). BR Rau was the only governor who was in office for 8 years (July 1949 to Jan 1957). Das' predecessors were Urjit Patel and Raghuram Rajan.

Under Shaktikanta Das, RBI announced more than 50 relief measures to mitigate COVID impact between March 2020 and August 2021. He was also responsible for bringing down rates to a historic low of 4 percent and kept liquidity in surplus to smoothen the pain.

From a quick rescue of Yes Bank to the takeover of DHFL and its successful resolution under IBC to managing the PMC Bank fiasco to pave way for its takeover, RBI under Shaktikanta Das has been taking swift action to protect depositors and preserve financial stability.

Some of the key reforms under Das include introduction of scale-based regulation of NBFCs, bringing the regulation of HFCs and Co-Op banks under RBI, overhauled MFI regulations, capping the tenure of private bank CEOs, introducing a regulatory sandbox for fintech, giving out account aggregator licence among others.

Microsoft to build a new data centre to support Thailand's tec

Microsoft has revealed intentions to construct a regional data centre as w...

SAP launches cloud services to help Indian scaleups innovate m

SAP at SAP unveils now "GROW with SAP for Scaleups," a new cloud service d...

Denodo and Sonata form alliance to unlock data-to-value creati

Denodo and Sonata Information Technology India Limited (SITL) have annou...

Google Play Store will now let users download two apps simulta

Google Play Store now lets users download two apps simultaneously. While a...

Technology Icons Of India 2023: Sunil Bharti Mittal

Sunil Bharti Mittal is the Founder and Chairman of Bharti Enterprises,...

Technology Icons Of India 2023: Madhabi Puri Buch

Madhabi Puri Buch is the chairperson of the securities regulatory body...

Technology Icons Of India 2023: Rajiv Memani

As Chair of the EY Global Emerging Markets Committee, Rajiv connects e...

New defence PSUs will help India become self-reliant

MIL, India’s biggest manufacturer and market leader is engaged in Pr...

EESL encouraging e-mobility adoption across India

Energy Efficiency Services Limited (EESL) is a Super Energy Service Co...

BEL leveraging next generation technologies to keep the country ahead in Defence space

Bharat Electronics Limited (BEL) is a Navratna PSU under the Ministry ...

SAVEX TECHNOLOGIES PVT. LTD.

Savex Technologies is the 3rd largest Information & Communication Tec...

ACCERON INFOSOL PVT. LTD.

It is a leading value added distributor in the IT security space and h...

Crayon Software Experts India Pvt Ltd

Crayon helps its customers build the commercial and technical foundati...