Swiggy becomes a decacorn after doubling its valuation to $10.7 billion in latest fundraise

By MYBRANDBOOK

Food-delivery giant Swiggy has doubled its valuation to $10.7 billion after raising $700 million in an Invesco-led new funding, which has made the outfit a decacorn, according to sources. Swiggy’s latest valuation is almost double that of Zomato, before the latter went for its initial public offering. Before its IPO, Zomato was valued at $5.4 billion.

The funding round saw participation from a host of investors such as Baron Capital Group, Sumeru Venture, IIFL AMC Late Stage Tech Fund, Kotak, Axis Growth Avenues AIF- I, Sixteenth Street Capital, Ghisallo, Smile Group, and Segantii Capital.

Swiggy’s existing investors Alpha Wave Global (formerly Falcon Edge Capital), the Qatar Investment Authority, and ARK Impact, along with its long-term investor Prosus, also participated in the round.

Swiggy has surged past budget hospitality company Oyo, whose valuation dropped to $8 billion in 2020 from $10 billion in 2019, and then increased to $9 billion in 2021.

Swiggy has overtaken sports technology company Dream Sports, the parent firm of fantasy sports platform Dream11.

This investment in Swiggy comes at a time when the adoption of food and online grocery is accelerating and consumer demand for Swiggy’s many services continues to grow.

The fundraise will help Swiggy to accelerate growth on the core platform and make meaningful investment to grow Instamart, its quick commerce grocery service which remains well-positioned to continue to lead the emerging space.

The company will also strengthen its investment in the broader ecosystem and will give firepower to take on rivals such as Zomato, Amazon, Flipkart, Dunzo, Licious, and Ola Foods.

“The GMV our food-delivery business achieved in 40 months took Instamart just 17 months, demonstrating the platform benefits of Swiggy. We will double down on this to build more categories,” said Sriharsha Majety, chief executive officer and co-founder, Swiggy.

“Our goal is to make Swiggy the platform that 100 million consumers can use 15 times a month. We will continue to invest in our people, products, and partners,” he added.

Swiggy had closed a $1.25-billion fundraise last year in July, marking the first investment in the category by SoftBank Vision Fund 2. After the funding, the valuation of the start-up rose by more than 50 per cent to $5.5 billion from $3.6 billion earlier, according to industry sources.

In the past few months, Swiggy has expanded Instamart to 19 cities. Swiggy Genie, Swiggy’s pick-up and drop service, is present in 68 cities, while its meat-delivery service and daily grocery service, Supr Daily, are present across all major Indian cities. It also launched Swiggy One, India’s first comprehensive membership programme with benefits across food, groceries, and other on-demand services.

“As long-term investors, the Invesco Developing Markets Fund seeks investment opportunities in the best companies in the world, led by world-class management teams that have the potential for long-term structural growth,” said Justin Leverenz, chief investment officer, Invesco Developing Markets Fund.

“Our investment in Swiggy represents one such investment.”

Google Pay has added "Open Wallet" shortcut

With the introduction of the "Open Wallet" shortcut, Google Pay has impro...

TRAI targets to finalise National Broadcast Policy by May-end

The Telecom Regulatory Authority of India will finalise the National Broa...

TAC Security becomes Cyber Security Assessor for the App Defen

The cybersecurity company, TAC Security has been selected as a key Cyber ...

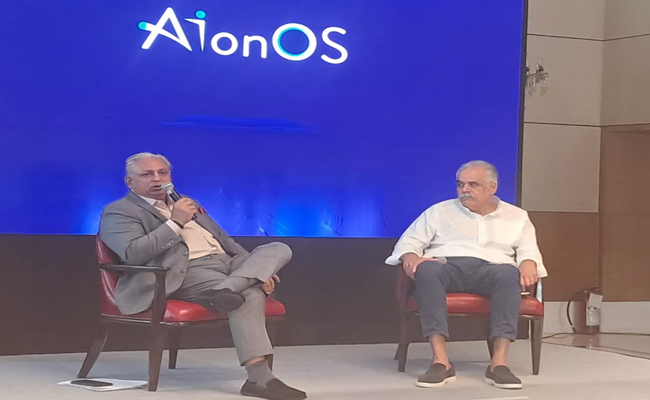

InterGlobe’s Rahul Bhatia and C.P. Gurnani together announce

In a move that is set to transform the AI landscape, Rahul Bhatia, Group M...

Technology Icons Of India 2023: Shailendra Katyal

Shailendra is instrumental in Lenovo achieving the no.1 position in PC...

Technology Icons Of India 2023: Deepinder Goyal

Deepinder Goyal is the Founder and CEO of Zomato. Deepinder, or Deepi,...

Technology Icons Of India 2023: Sandip Patel

Sandip Patel is the Managing Director, IBM India/South Asia. He is res...

ITI Limited widening its focus area

ITI Limited is a public sector undertaking company, has manufacturing ...

C-DOT enabling India in indigenous design, development and production of telecom technologies

An autonomous telecom R&D centre of Government of India, Center of Dev...

New defence PSUs will help India become self-reliant

MIL, India’s biggest manufacturer and market leader is engaged in Pr...

ACCERON INFOSOL PVT. LTD.

It is a leading value added distributor in the IT security space and h...

INFLOW TECHNOLOGIES PVT. LTD.

Inflow Technologies is a niche player in the IT Infrastructure Distrib...

REDINGTON INDIA LIMITED

Redington (India) Limited operates in the IT product distribution busi...