Card payments in Hong Kong to register subdued growth of 1.2% in 2020

By MYBRANDBOOK

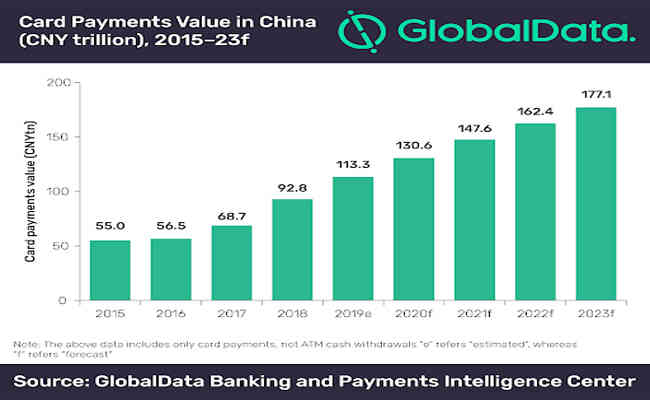

The lockdown and social distancing measures in Hong Kong due to COVID-19 has resulted in the closure of businesses and decline in consumer spending. As a result, card payments are estimated to register a subdued 1.2% growth this year, forecasts GlobalData, a leading data and analytics company.

As per the report, card payments market is expected to revive in the coming months with gradual reopening of businesses, easing of travel restrictions and potential launch of COVID-19 vaccine. The value of card payments is expected to increase at a compound annual growth rate (CAGR) of 3.9% between 2020 and 2024 to reach HK$1,241.7bn (US$159.4bn) in 2024.

Nikhil Reddy, Banking and Payments Analyst at GlobalData, comments: “The global trade war followed by Hong Kong protests (also known as anti-extradition law movement) affected the country’s economy, a situation which further worsened by the COVID-19 crisis. The downturn in economic growth has affected consumers’ buying capacity and subsequently impacted card payment.”

Credit cards is the most affected of all the card types. According to the Hong Kong Monetary Authority, credit card transaction value (including card payments at POS and cash withdrawals) registered a 11% decline in Q1 2020 compared to previous quarter. Debit cards, on the other hand, saw marginal rise of 0.9% during the same period.

According to GlobalData’s 2020 Banking & Payments Survey*, while card payments have declined in Q1 2020*, there is a rise in contactless card payments. To encourage contactless payments, the government introduced subsidy scheme for merchants in October 2020. Under this scheme, a subsidy of HK$5,000 (US$641.93) is offered to merchants to cover the cost of setting up contactless terminals and maintenance fees.

Mr Reddy concludes: “Hong Kong has a well-developed card payment market and strong payment infrastructure. While the current COVID-19 has caused a slowdown in its growth in 2020, it simultaneously brought major change in consumer preference towards non-cash tools such as contactless cards, which will in turn support card payments growth over the next few years.”

Legal Battle Over IT Act Intensifies Amid Musk’s India Plans

The outcome of the legal dispute between X Corp and the Indian government c...

Wipro inks 10-year deal with Phoenix Group's ReAssure UK worth

The agreement, executed through Wipro and its 100% subsidiary,...

Centre announces that DPDP Rules nearing Finalisation by April

The government seeks to refine the rules for robust data protection, ensuri...

Home Ministry cracks down on PoS agents in digital arrest scam

Digital arrest scams are a growing cybercrime where victims are coerced or ...

ICONS OF INDIA : VIJAY SHEKHAR SHARMA

Vijay Shekhar Sharma is an Indian technology entrepreneur and multimil...

ICONS OF INDIA : SHAILENDER KUMAR

Shailender Kumar is senior vice president and regional managing direct...

Icons Of India : Puneet Chandok

Puneet Chandok is President, Microsoft India & South Asia and is respo...

ECIL - Electronics Corporation of India Limited

ECIL is distinguished by its diverse technological capabilities and it...

RailTel Corporation of India Limited

RailTel is a leading telecommunications infrastructure provider in Ind...

LIC - Life Insurance Corporation of India

LIC is the largest state-owned life insurance company in India...

Indian Tech Talent Excelling The Tech World - RAVI KUMAR S, CEO- Cognizant

Ravi Kumar S, appointed as CEO of Cognizant in January 2023, sets the ...

Indian Tech Talent Excelling The Tech World - ANJALI SUD, CEO – Tubi

Anjali Sud, the former CEO of Vimeo, now leads Tubi, Fox Corporation�...

Indian Tech Talent Excelling The Tech World - NIKESH ARORA, Chairman CEO - Palo Alto Networks

Nikesh Arora, the Chairman and CEO of Palo Alto Networks, is steering ...

of images belongs to the respective copyright holders

of images belongs to the respective copyright holders