IT Hardware Industry : Momentum Maintained

By MYBRANDBOOK

The year 2018 did not offer many surprises for the Indian IT industry and, despite some challenges, it sustained the momentum it gained in the previous year

The Indian IT hardware industry in 2018 behaved the same way as it did in 2017 – no big spikes in the business nor a big plunge. The year maintained the momentum it gained in 2017 despite factors like demonetization and GST. While the server and printer market registered a significant growth, the PC market saw a decline primarily because of muted consumer demands in the last quarter. The industry also saw many enterprise customers in telecom domain putting a ‘hold’ on their big purchases keeping the big spends required in 5G in mind. The transition towards Industry 4.0 also slowed down some big ticket sales in manufacturing industry in the current year which would reflect in the coming quarters.

Overall, the industry showed resilience towards the market dynamics and kept adopting with the newer challenges, like processor shortages in PC industry in Q4, and thus maintained a steady growth.

Server Market

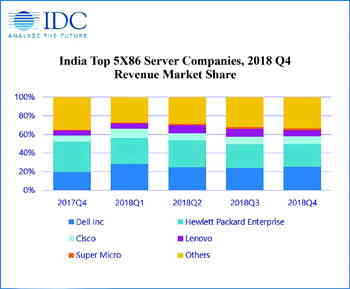

The overall server market in India showed a moderate growth of 4% in CY2018 to reach $1293 million in revenue as against $1243 million in CY2017. The first two quarters – Q1 and Q2 – showed significant growth of 33.7% and 15.9% respectively which was negated by a sharp decline in next two quarters -Q3 and Q4 – by 8.1% and 17.2% respectively.

While the first half of the year saw major deals coming from tier-1 telcos, large IT, ITeS companies, banking and retail showing the consecutive growth, the next two quarters saw dip in business majorly due to the absence of multi-million dollar deals from IT and ITeS service providers and spillover of telco deals in the coming quarters

While the first half of the year saw major deals coming from tier-1 telcos, large IT, ITeS companies, banking and retail showing the consecutive growth, the next two quarters saw dip in business majorly due to the absence of multi-million dollar deals from IT and ITeS service providers and spillover of telco deals in the coming quarters

The x86 server market accounts for 86.7 percent of the overall server market in terms of revenue. The contribution in the x86 market mostly came from the professional services vertical followed by manufacturing, telcos, and Government.

Investments in the infrastructure remain as the top priority for enterprise business applications, data management, content and collaboration, web infrastructure and application development and testing workloads.

The Intel-based x86 platforms are robust and provide the price-performance balance for enterprises looking to deploy these applications for their end users. However, the large enterprises from the data-intensive industries such as banking and telcos still prefer to use the non-x86 platforms to run their core applications demanding higher availability and performance.

If we consider the behaviour of the industry in Q4, the x86 server market in terms of revenue declined YoY by 17.2 percent to reach $267.1 million from $322.6 million in Q4 2017. Professional services, manufacturing, communications and media, and Government accounted for 84.8 percent of overall x86 server market revenue. Government saw the biggest Y/Y growth of 104.4 percent owing to the investments coming from various federal government departments and local state Government projects. The blade and rack servers which contributes for 78.6 percent revenue share has seen a surge in their ASPs due to the higher core, memory and processing configurations for newer workloads demanding higher IOPS.

The non-x86 server market also declined YoY by 17.1 percent to reach $41.1 million revenue, in Q4 2018. IBM tops the market with a revenue share of 74.3 percent, followed by HPE with share of 23.9 and Oracle with 1.8 percent during Q4 2018. Banking remains top vertical with 52.0 percent revenue share followed by manufacturing and professional services with 18.9 percent, and 9.0 percent respectively, during Q4 2018.

In Q4 2018, Dell Inc. and Hewlett Packard Enterprise (HPE) tied for the pole position in the India x86 server market with revenue share of 25.3 percent and 24.6 percent to reach $67.6 million and $65.7 million respectively. Dell Inc. continued to show its good performance throughout 2018, as a result their business grew YoY by 44.2 percent at end Q4 2018. Cisco was able to register the revenue share of 8.1 percent followed by Lenovo who stood at 6.6 percent revenue share at the end of Q4 2018. ODM direct continued supporting the DC capacity expansion of tier-1 cloud providers in India and now accounts for 26.2 percent revenue share in Q4 2018.

Going forward, the year 2019 is expected to show better results as pending from Central Government was an all-time high in Q4 2018 owing to the initiation of new projects related to various ministries under the central Government. First quarter of 2019 is expected to be big due to large projects in the Government sector across education and smart cities segments, while the general election in 2019 would slow down the overall growth of server market during 2019.

It is also expected that telecommunications spending to come from the initiatives such as IMS stack for VoLTE, VRAN, 5G testbed programs towards 5G development and network expansion. Some of the banks refresh are expected to keep banking vertical stable for 2019 whereas manufacturing spend would be focused towards implementation of ERP, SCM and CRM applications.

External Storage Market

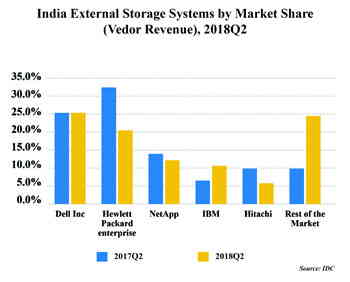

India’s external storage market is witnessing a double growth with the demand comes from Professional services, BFSI, manufacturing, telecommunications and government industries.

Increasing data generation from client interaction, growing into main stream with the strong growth of internet penetration ,growing smartphones, entertainment and various disruptive technologies including AI, Bigdata,IoT and increasing data from smart cities has influenced the growth. Another factor influencing like, increasing technology advancements in data storage and growing adoption of flash technology is anticipated to drive India data storage market during the forecast period. Secondly, increasing in internet population, growing use of cloud storage and high speed data access technologies is anticipated to drive India data storage market through 2021. The market for external storage in India is growing at 10% annually and is slated to grow at a CAGR of 5.6% over next five years.

Infrastructure modernization to improve agility and scalability is of high importance for today’s organizations. This trend is compelling organizations to deploy/consider new age storage solutions. Another factor of the SSD prices has declined rapidly, it has impacted the demand outlook for HDDs negatively. Accordingly, the enterprise HDD petabyte demand has grown more slowly for all years which has expected in the previous HDD forecast. The HDD industry revenue steadily declining from $24.4 billion in 2018 to $21.2 billion in 2023.The external storage market in India grew at 16.7 per cent (year-on-year) in 2018, which is one of the highest in the world.

Infrastructure modernization to improve agility and scalability is of high importance for today’s organizations. This trend is compelling organizations to deploy/consider new age storage solutions. Another factor of the SSD prices has declined rapidly, it has impacted the demand outlook for HDDs negatively. Accordingly, the enterprise HDD petabyte demand has grown more slowly for all years which has expected in the previous HDD forecast. The HDD industry revenue steadily declining from $24.4 billion in 2018 to $21.2 billion in 2023.The external storage market in India grew at 16.7 per cent (year-on-year) in 2018, which is one of the highest in the world.

The most popular external storage device for the Indian companies is an all-flash storage array (AFA) -- a storage architecture designed to take advantage of solid-state memory technology. Increased storage spending from professional services organizations drove the incremental growth in Q3 2018. Professional services, banking, manufacturing, telecommunications and government industries contributed close to 82% of overall external storage market in Q3 2018.

External storage offers hard disk drives (HDDs) or solid state drives (SSDs), all-flash and hybrid storage arrays for block, file or object-based storage, or a mix of these. However, the majority of the vendors started offering NVMe based flash arrays to drive an incremental growth in the coming quarters.

Midrange external storage segment saw an exponential YoY growth and continued to lead the market constituting more than 66.9% of the total Q3 2018 external storage market, while both entry-level and high-end storage segments declined YoY in Q3 2018.

India is seeing growth and leading the Information Transformation. Majority of the OEMs are focusing on new technologies and innovative pricing models to ensure traditional external storage consumption in the market in the wake of increasing acceptance of cloud storage solutions across organizations.

Major Vendors Analysis

Other growth factors like, online media consumption has shown tremendous growth over the past few years. Among the digital devices, mobile devices have taken over as the preferred medium of consuming online media. The smartphone market has seen an unprecedented growth in the last 2 years. Smartphones sales are going to touch 4.6 billion in 2019. This increase in the number of mobile devices is making it easier for consumers to access music and video content on the go.

Dell EMC is currently number one in India in the external storage market, followed by Hewlett Packard Enterprise with 18.0% market share in Q3 2018. Smaller external storage OEMs including Netapp, Lenovo and Hitachi Vantara has witnessed a significant YoY growth due to large multi-million-dollar deals from professional services organizations in Q3 2018. Dell EMC’s mid-range business grew by 20% and in a market in India; price point is one of the key factor.

The growth of storage products and solutions are influenced with the vision of Indian CIOs, their looking into a cost-effective, modern, scalable, secure and hybrid Cloud experience, they are gradually moving their operations to Cloud-enabled, software-defined data centres.

Indian enterprises are now striving for Hybrid Cloud and multi-Cloud offerings where the same ease, simplicity and security can be achieved on-premise that a Cloud-only environment is expected to provide, in less cost.

The sheer volume of data and its importance to business operations make data protection much more challenging. Disruption incidents are occurring frequently, but more alarming is the increasing amount of irreversible data loss. More than three-quarters (76%) of respondents in India and globally experienced some type of disruption within a 12-month period. Moreover, around 30% of Indian businesses said (27% globally) that they were unable to recover data using their existing data protection solution.

Around 85% of India respondents are using at least two data protection vendors, in comparison to 75% worldwide. The most common type of disruption faced by organizations in India using two or more vendors were -

* Unplanned systems downtime (51%)

* Data loss (36%)

* Local disaster that affected access to data for an entire site/group (34%)

Although unplanned systems downtime is more prevalent, data loss is far more expensive. For example, in India, those who encountered downtime experienced 29 hours of downtime on average in the last 12 months, costing $958, 583 (vis-à-vis 20 hours of downtime for global leaders, costing about $ 526,845). Indian respondents said that they lost more data than global & APJ counterparts, averaging 3.31 terabytes lost with a price tag of $1,287,788 (vis-a-via 2.13 terabytes costing $995,613 globally). It’s clear that organizations now recognize both at India (95%) and global level (81%) to take data protection more seriously for categories of data that have the greatest monetary value.

Challenges Surrounding Data Protection

Although, most of the Indian businesses are struggling to implement a solution that adequately fits their needs, data protection “adopters” sprang forward by nearly 50 percentage points from 2016 to 2018. Moreover, data protection “leaders” in India increased by 29 percentage points between 2016 to 2018, nearly 20 percentage points more than global counterparts.

The majority, 94% of India respondents said that they faced at least one challenge in relation to data protection (Globally: 95%). The top challenges in India include -

The majority, 94% of India respondents said that they faced at least one challenge in relation to data protection (Globally: 95%). The top challenges in India include -

The lack of data protection solutions for emerging technologies

Inability to keep track and protect all data because of growth of DevOps and cloud developments

The complexity of configuring and operating data protection software/hardware

For those who are struggling to find adequate data protection solutions for newer technologies, 71% in India said they could not find suitable data protection solutions for artificial intelligence and machine learning data, followed by cloud-native applications (58%) and robotic process automation (46%).

However, the challenges presented by emerging technologies and the rapid growth of data are just beginning to take shape. As such, more than 1/3rd (32%) in Indian respondents believe that their current data protection solutions will be able to meet all future business challenges as compared to only 16% globally.

Cloud Is Changing the Data Protection Landscape

As per the Global Data Protection Index 2018, public cloud use in India has increased from 34%to 44% (Globally: Currently 40%, 28% in 2016) of the total IT environment in organizations between 2016-2018. Moreover, 100% of Indian organizations said that they are using public cloud as part of their data protection infrastructure (Globally 98%).

The top use cases for data protection within public cloud in India are -

Backup/snapshot services to protect workloads developed in public cloud using new application architectures (62%)

Cloud-enabled versions of on-premises data protection software to protect public cloud workloads (59%)

Backup/snapshot services to protect workloads developed in public cloud using legacy application architectures (52%)

Regulation Is an Impending Catalyst for Evolution

The research shows that 72% of Indian businesses felt very confident that their organization’s current data protection infrastructure and processes are compliant with regional regulations, in comparison with only 35% globally.

Lastly, with the rapid change in industry dynamics and the advent of newer technologies, it has become imperative for organizations to focus on the practical application of emerging technologies like AI and IoT to accelerate their digital transformation journey. The key in organizations’ digital transformation journey is the generation and analysis of data. Businesses in India are seeing better potential in the value of data & are monetizing it more than its global counterparts. This is a testimony of our progress as a nation highlighting our level of preparedness for the future security outbreaks.”

PC Market

The overall India traditional PC market shipments for the calendar year 2018 stood at 9.3 million units, a decline of 2.8% Year-on-Year. This was primarily due to the muted consumer demand and the absence of large special projects in Q4 as shipments for the quarter stood at 1.99 million units, down by 23.8% YoY and 26.7% QoQ.

The overall market saw good momentum in H1 2018 due to stable consumer spending and the execution of special projects. However, the market witnessed challenges in H2 2018 in both consumer and commercial segment owing to the aggressive stocking of inventory, drop in demand and impact of processor shortages.

All-in-One, Ultrasmall and small desktops saw a combined growth of 23% YoY, while convertibles and ultraslim notebooks observed a cumulative growth of 75% YoY. Traction towards exciting new categories such as branded gaming notebooks continued in CY2018, clocking a growth of 123% YoY. Gaming and new form factors have been driving the growth of the premium market segment in CY2018.

All-in-One, Ultrasmall and small desktops saw a combined growth of 23% YoY, while convertibles and ultraslim notebooks observed a cumulative growth of 75% YoY. Traction towards exciting new categories such as branded gaming notebooks continued in CY2018, clocking a growth of 123% YoY. Gaming and new form factors have been driving the growth of the premium market segment in CY2018.

In CY2018, the consumer market dropped by 1.5% and recorded an overall shipment of 4.54 million units. Consumer Notebook shipments saw a growth of 0.7% over last year owing to increase in demand for growing categories like gaming and ultraslim notebooks, thereby commanding a share of 82% out of the overall consumer PC market while Consumer desktops saw an annual decline of 10.2% due to the weakening contribution of the unbranded desktops.

In CY2018, the commercial shipments declined by 4%, recording a total volume of 4.76 million units, as the year did not see any large-scale special projects in the education segment. Large and Very Large businesses saw a total growth of 17.6% YoY. Companies in IT/ITES and BFSI have been driving the spending in the Enterprise segment.

The drop is largely attributed to the sluggish demand from the SMB segment owing to credit uncertainty and lack of execution of large special projects. Moreover, challenges in fulfilling enterprise orders due to processor shortages also accounted for the drop in commercial volumes.

HP led the overall India traditional PC market with a 31.0% share in CY2018 and recorded a YoY shipment growth of 0.6%. The vendor has maintained its dominance in the consumer PC market in CY2018, growing 5.6% YoY due to continuous engagement with channel community and penetration across Tier 2 and Tier 3 states to increase footprint and build brand awareness. The vendor led the commercial segment in CY2018 with key strategic wins in enterprise accounts in IT/ITES vertical but registered a decline of 3.9% in shipments YoY as the vendor was not able to execute high-volume special projects in the public sector segment.

Dell remained second with a 23% share in CY2018 but witnessed a soft decline YoY in shipments by 0.2% in the overall traditional PC market. In the consumer market, Dell Inc. was down by 11.5% YoY owing to challenges within the channel towards H2 2018. The vendor recorded a growth of 10.6% YoY in the commercial segment, driven by the refresh in enterprise demand and strong positioning within global accounts across the large and very large business.

Lenovo held the third position with a 20.6 % market share in the overall India traditional PC market in CY2018, which is a marginal decline of 1.3% in shipments YoY. The consumer PC business grew by 17.0% YoY in CY2018 as the company aggressively captured consumer mindshare in the ultraslim notebook category and continued with online channel focus and regional exclusive store penetration. Lenovo’s commercial segment dropped by 13.3 % YoY in the year as the company did not witness the execution of large manifesto projects. However, the company saw strong growth in the Enterprise and SMB segments.

Indian Printer Market

India Hardcopy Peripherals (HCP) or the printer market posted yearly shipments of 3.7 million units in CY2018, registering a Year-on-Year (YoY) growth of 5.5%. In 2017, the total shipment number was 3.5 million units. In 2018 the market posted shipments of approx. 0.85 million units, a YoY decline of 2.6%, as per latest IDC Asia/Pacific Quarterly Hardcopy Peripherals Tracker , CY2018Q4. While the months following the festive season, online sale are usually on the lower side but 2018Q4 saw an unusually low demand from the consumer end, a stark contrast with the overall CY2018 trend.

The annual growth was led by Inkjet printers, specifically Ink Tank printers which grew by 21.4% and now command 68.4% of the overall Inkjet market in India. The online sales during 2018Q3 played a significant role in catering to the increased demand from the Consumer and SMB segment. The year ended with the Inkjet market commanding more than half of the HCP market followed closely by Laser.

The Laser market also expanded by 3.7% on the back of strong demand from SMBs and Government’s tight monitoring of the refurbished copier market. Government’s increased seizing of illegal units at major ports has given the market players ample opportunities to expand their customer base by targeting the users of these machines with attractive pricing schemes,” adds Johri.

In the last quarter, Inkjet printer shipments grew by 2.9% YoY with a contribution of 50.0% to overall India HCP market. Growth in inkjet printer shipments was led by Ink tank printers which recorded YoY growth of 10.5%. The overall laser printer market declined YoY by 4.8%. However, the laser copier market continued the growth momentum and registered a healthy YoY growth of 28.2%.

The market performed much below the expectations in 2018Q4 because of a combination of factors like excess inventory being carried forward from 2018Q3 owing to a drop in festive buying from consumers, aggravated further by channel partner issues across the country. Demand from SOHOs/SMEs was also reduced because of restricted lending to this segment from the banks. Government spending has also slowed down considerably in anticipation of the upcoming elections.

HP Inc. (Excluding Samsung) maintained its leadership in CY2018 HCP market with a market share of 40.2% and a marginal YoY shipment decline of 0.6%. While the inkjet segment slowed down because of decline in ink cartridge-based printer shipments, the laser segment compensated for the same. HP experienced good traction for entry level A4 laser printers due to extensive promotions, schemes and multiple projects. On the Copier side, HP grew significantly in CY2018 with a shipment growth of 202% and a market share of 11.4%.

Epson maintained its 2nd position in the overall CY2018 HCP market with a 15.0% YoY growth and it also continued to hold its leadership in inkjet segment with a unit share of 45.1% and YoY growth of 18.7%. The growth is primarily attributed to the Epson’s channel depth and multiple channel schemes in the first half of the year. Increased promotional activities for the new Ink tank models also contributed to its growth.

Canon recorded YoY growth of 12.8% in CY2018 and maintained its 3rd position in the HCP market. In the copier segment, it maintained its leadership position with a 29.1% unit market share. The Government’s strict regulations on the refurbished market coupled with Canon’s increased focus on the Corporate segment helped to maintain its dominance in the copier market. In the Inkjet market, Canon saw strong YoY growth of 39.7% because of its increased focus on the ink tank segment through attractive channel schemes, End-user promotions and increased promotional campaigns.

Market research firm IDC expects the overall HCP market to decline in Q1, 2019 due to weak consumer and SMB sentiment. While overall inkjet market is expected to decline, Ink tank printers are likely to be the only bright spot in 2019Q1 as vendors continue pushing them aggressively. Moreover, the Government segment is likely to withhold on spending before the general elections leading to decline in demand for laser printers. Despite decline in government spending, demand for laser copiers is expected to remain steady owing to continued crackdown of refurbished copier market by government.

"

Happiest Minds brings in an innovative GenAI chatbot

Happiest Minds Technologies has announced the new GenAI chatbot - ‘hAPPI...

Government mandates encryption for CCTV cameras to ensure netw

In the wake of issuing an internal advisory on securing CCTV cameras at g...

TRAI recommends allowing only Indian entities to participate i

The Telecom Regulatory Authority of India (TRAI) has recommended that onl...

Galaxy AI is available on more devices with Samsung One UI 6.1

Samsung has expanded the range of smartphones to which One UI 6.1 and Gala...

Technology Icons Of India 2023: Hari Om Rai

Hari Om Rai is the Co-founder, Chairman & Managing Director of Lava In...

Technology Icons Of India 2023: Rajiv Srivastava

Rajiv Srivastava is the Managing Director of Redington Group. With 35 ...

Technology Icons Of India 2023: Mukesh D. Ambani

An Indian billionaire businessman Mukesh Dhirubhai Ambani is currently...

ITI Limited widening its focus area

ITI Limited is a public sector undertaking company, has manufacturing ...

C-DAC keeps India ahead in IT & Electronics R&D space

Centre for Development of Advanced Computing (C-DAC) is the premier R&...

C-DOT enabling India in indigenous design, development and production of telecom technologies

An autonomous telecom R&D centre of Government of India, Center of Dev...

INTEGRA MICRO SYSTEMS PVT. LTD.

Integra is a leading provider of innovative hi-technology products an...

R P TECH INDIA

R P Tech is recognized for its diverse products portfolio, value-add...

NETPOLEON SOLUTIONS

Netpoleon Group is a Value-Added Distributor (VAD) of Network Security...