E-Commerce Industry : AT THE CUSP OF EVOLUTION

By MYBRANDBOOK

The e-commerce has transformed the way business is done in India. Driven by technology and modernisation, the retail sector in India is at the cusp of evolution. Disruptions throughout the value chain – sourcing, manufacturing, transportation, procurement, warehousing and inventory, distribution, marketing and advertising, selling, logistics, delivery, after sales servicing, etc. – are driving this evolution, not just in retail but throughout the broader consumer business practices.

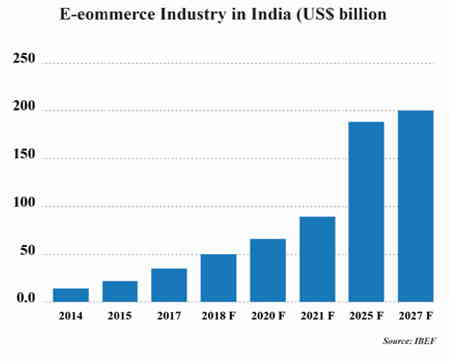

The Indian e-commerce market is expected to grow to $200 billion by 2026 from $ 38.5 billion as of 2017, according to a report by IBEF. Much growth of the industry has been triggered by increasing internet and smartphone penetration. The ongoing digital transformation in the country is expected to increase India’s total internet user base to 829 million by 2021 from 560.01 million as of 2018. India’s internet economy is expected to double from US$125 billion as of April 2017 to US$ 250 billion by 2020, majorly backed by ecommerce. India’s E-commerce revenue is expected to jump from US$ 39 billion in 2017 to US$ 120 billion in 2020, growing at an annual rate of 51 per cent, the highest in the world.

Market Size

India is Asia’s third largest and the world’s fourth largest retail market. The retail market in India is expected to grow from $795 billion in 2017 to $1.2 trillion by 2021. Further, as the internet penetration in the country increases and more international retailers start operating in India, the share of organized retail market is expected to increase from approximately 12% in 2017 to 22-25% by 2021. This will also be driven by the growth of e-commerce market from $24 billion in 2017 to $84 billion in 2021, according to Deloitte.

Propelled by rising smartphone penetration, the launch of 4G networks and increasing consumer wealth, the Indian e-commerce market, according to IBEF, is expected to grow to $ 200 billion by 2026 from $ 38.5 billion in 2017 Online retail sales in India are expected to grow by 31% to touch $ 32.70 billion in 2018, led by Flipkart, Amazon India and Paytm Mall. During 2018, electronics is currently the biggest contributor to online retail sales in India with a share of 48%, followed closely by apparel at 29%, the report pegs.

Propelled by rising smartphone penetration, the launch of 4G networks and increasing consumer wealth, the Indian e-commerce market, according to IBEF, is expected to grow to $ 200 billion by 2026 from $ 38.5 billion in 2017 Online retail sales in India are expected to grow by 31% to touch $ 32.70 billion in 2018, led by Flipkart, Amazon India and Paytm Mall. During 2018, electronics is currently the biggest contributor to online retail sales in India with a share of 48%, followed closely by apparel at 29%, the report pegs.

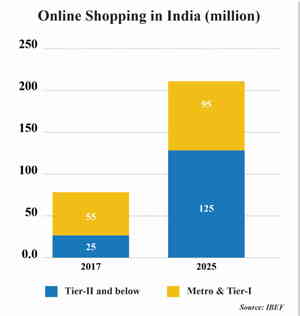

India’s e-commerce market has the potential to grow more than four folds to US$ 150 billion by 2022 supported by rising incomes and surge in internet users. Online shoppers in India are expected to reach 120 million in 2018 and eventually 220 million by 2025. Average online retail spending in India was US$ 224 per user in 2017.

Key Drivers

The biggest driver of ecommerce growth in any country is the ease of conducting the commerce. It does allow the customers to buy things at their convenience, without physically visiting any store, without even carrying the stuff themselves and making the payment digitally.

What is enabling this process is the phenomenal rise in internet and smartphone adoption in the country. Close to 40% of India’s mobile phone users now are smartphone users and there are more than 500 million people who use internet on a regular basis. This huge mass is driving the e-commerce growth in India.

What further adding to the growth is the ease of making payment for the purchases made. India’s digital payment market is the fastest growing in the world, though in absolute numbers, it’s still miniscule. Post demonetization, there was a huge growth in digital payments, customers are having multiple mobile wallets and the more and more merchants are adopting e-money every passing day.

On top of this, many e-commerce service providers are also offering cash on deliver (CoD) facility that puts a customer at his comfortable best to do the purchase as he is able to dispel the little distrust he has on the e-commerce process of fearing the loss of his money.

A young demographic profile, rising internet penetration and relative better economic performance are the key drivers of this sector. The Government of India’s policies and regulatory frameworks such as 100 per cent foreign direct investment (FDI) in B2B e-commerce and 100 per cent FDI under automatic route under the market place model of B2C e-commerce are expected to further propel growth in the sectors. As of August 2018, the government is working on the second draft of e-commerce policy, incorporating inputs from various industry stakeholders. In February 2019, the Government of India released the Draft National e-Commerce Policy which encourages FDI in the marketplace model of e-commerce. Further, it states that the FDI policy for e-commerce sector has been developed to ensure a level playing field for all participants. According to the draft, a registered entity is needed for the e-commerce sites and apps to operate in India.

A young demographic profile, rising internet penetration and relative better economic performance are the key drivers of this sector. The Government of India’s policies and regulatory frameworks such as 100 per cent foreign direct investment (FDI) in B2B e-commerce and 100 per cent FDI under automatic route under the market place model of B2C e-commerce are expected to further propel growth in the sectors. As of August 2018, the government is working on the second draft of e-commerce policy, incorporating inputs from various industry stakeholders. In February 2019, the Government of India released the Draft National e-Commerce Policy which encourages FDI in the marketplace model of e-commerce. Further, it states that the FDI policy for e-commerce sector has been developed to ensure a level playing field for all participants. According to the draft, a registered entity is needed for the e-commerce sites and apps to operate in India.

Investments/ Developments

Flipkart, after getting acquired by Walmart for US$ 16 billion, is expected to launch more offline retail stores in India to promote private labels in segments such as fashion and electronics. In September 2018, Flipkart acquired Israel based analytics start-up Upstream Commerce that will help the firm to price and position its products in an efficient way. Paytm has launched its bank - Paytm Payment Bank. Paytm bank is India’s first bank with zero charges on online transactions, no minimum balance requirement and free virtual debit card As of June 2018, Google is also planning to enter into the E-commerce space by November 2018. India is expected to be its first market.

E-commerce industry in India witnessed 21 private equity and venture capital deals worth US$ 2.1 billion in 2017 and 40 deals worth US$ 1,129 million in the first half of 2018. Google and Tata Trust have collaborated for the project ‘Internet Saathi’ to improve internet penetration among rural women in India which will give a further boost to e-commerce in rural areas which has so far remained fairly untouched.

According to EY, E-commerce and consumer internet companies in India received more than US$ 7 billion in private equity and venture capital in 2018.

E-commerce and consumer internet companies in India received more than US$ 7 billion in private equity and venture capital in 2018. Online retail sales in India are expected to grow by 31 per cent to touch US$ 32.70 billion in 2018, led by Flipkart, Amazon India and Paytm Mall. Online retail is expected to contribute 2.9 per cent of retail market in 2018.

Much growth of the industry has been triggered by increasing internet and smartphone penetration. Internet penetration in India grew from just 4 per cent in 2007 to 34.42 per cent in 2017, registering a CAGR of 24 per cent between 2007 and 2017. As of September 2018 overall internet penetration in India was 42.87 per cent. The number of internet users in India is expected to increase from 560.01 million as of September 2018 to 829 million by 2021. Internet penetration in rural India is expected to grow as high as 45 per cent by 2021 compared to the current rate of 21.76 per cent. The e-commerce retail logistics market in India is estimated at US$ 1.35 billion in 2018 and is expected to grow at a 36 per cent CAGR over the next five years.

Government initiatives

Since 2014, the Government of India has announced various initiatives namely, Digital India, Make in India, Start-up India, Skill India and Innovation Fund. The timely and effective implementation of such programs will likely support the e-commerce growth in the country.

Some of the major initiatives taken by the government to promote the e-commerce sector in India are as follows:

• In order to increase the participation of foreign players in the e-commerce field, the Indian Government hiked the limit of foreign direct investment (FDI) in the E-commerce marketplace model for up to 100 per cent (in B2B models).

• In the Union Budget of 2018-19, government has allocated Rs 8,000 crore (US$ 1.24 billion) to BharatNet Project, to provide broadband services to 150,000 gram panchayats

• As of August 2018, the government is working on the second draft of e-commerce policy, incorporating inputs from various industry stakeholders.

• The heavy investment of Government of India in rolling out the fiber network for 5G will help boost ecommerce in India.

• In February 2019, the Government of India released the Draft National e-Commerce Policy which encourages FDI in the marketplace model of e-commerce. Further, it states that the FDI policy for e-commerce sector has been developed to ensure a level playing field for all participants. According to the draft, a registered entity is needed for the e-commerce sites and apps to operate in India.

Road Ahead

The e-commerce industry been directly impacting the micro, small & medium enterprises (MSME) in India by providing means of financing, technology and training and has a favourable cascading effect on other industries as well. The Indian e-commerce industry has been on an upward growth trajectory and is expected to surpass the US to become the second largest e-commerce market in the world by 2034. Technology enabled innovations like digital payments, hyper-local logistics, analytics driven customer engagement and digital advertisements will likely support the growth in the sector. The growth in e-commerce sector will also boost employment, increase revenues from export, increase tax collection by ex-chequers, and provide better products and services to customers in the long-term.

The e-commerce industry been directly impacting the micro, small & medium enterprises (MSME) in India by providing means of financing, technology and training and has a favourable cascading effect on other industries as well. The Indian e-commerce industry has been on an upward growth trajectory and is expected to surpass the US to become the second largest e-commerce market in the world by 2034. Technology enabled innovations like digital payments, hyper-local logistics, analytics driven customer engagement and digital advertisements will likely support the growth in the sector. The growth in e-commerce sector will also boost employment, increase revenues from export, increase tax collection by ex-chequers, and provide better products and services to customers in the long-term.

Despite these positives in the Indian market, the industry seems to be little concerned about what lies for them in future considering the government’s new FDI policy for e-commerce. The new policy says that online marketplaces can no longer sell exclusive products on their platform and a vendor cannot supply more than 25% of its inventory. This created some flutter in the market, so much so that analyst firms like Morgan Stanley expressed concern that Walmart may like to exit Flipkart.

"

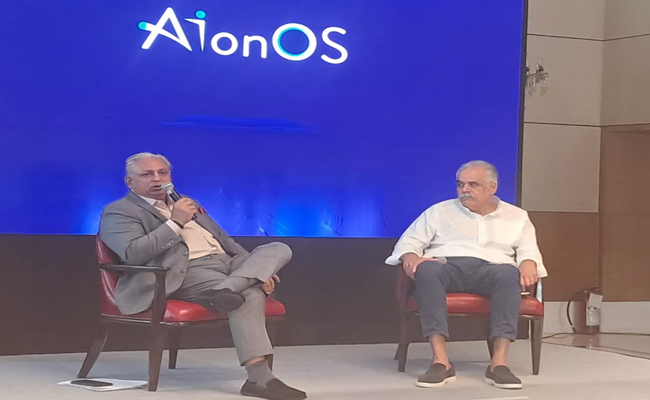

InterGlobe’s Rahul Bhatia and C.P. Gurnani together announce

In a move that is set to transform the AI landscape, Rahul Bhatia, Group M...

Download masked Aadhaar to improve privacy

Download a masked Aadhaar from UIDAI to improve privacy. Select masking w...

Sterlite Technologies' Rs 145 crore claim against BSNL rejecte

An arbitrator has rejected broadband technology company Sterlite Technolog...

ID-REDACT® ensures full compliance with the DPDP Act for Indi

Data Safeguard India Pvt Ltd, a wholly-owned subsidiary of Data Safeguard ...

Technology Icons Of India 2023: B.V.R. Subrahmanyam

B.V.R. Subrahmanyam belongs to Andhra Pradesh. He is a 1987-batch IAS ...

Technology Icons Of India 2023: Girish Mathrubootham

Girsh Mathrubootham envisioned and co-founded Freshworks. Freshworks, ...

Technology Icons Of India 2023: Hari Om Rai

Hari Om Rai is the Co-founder, Chairman & Managing Director of Lava In...

Aadhaar: Architecting the World's Largest Biometric Identity System

The Unique Identification Authority of India (UIDAI) is a statutory au...

HPCL is transforming the energy landscape, across the nation and beyond

HPCL is world-class energy company known for caring and delighting the...

GeM maintains transparency in online procurement of goods & services

Created in a record time of five months, Government eMarketplace is a ...

INTEGRA MICRO SYSTEMS PVT. LTD.

Integra is a leading provider of innovative hi-technology products an...

IRIS GLOBAL SERVICES PVT. LTD.

Iris Global services is one of the leading distribution houses that d...

B D SOFTWARE

BD Software is the distributor of IT security solutions in India. The ...