Banks' Endeavour to Buyout NBFCs' Loan Book is Synergetic

By MYBRANDBOOK

India Ratings and Research (Ind-Ra) believes that the steps taken by Reserve Bank of India (RBI) to support systemic liquidity and State Bank of India (SBI; IND AAA/Stable) to offer balance sheet liquidity for non-banking financial companies (NBFCs) would help alleviate some of the ongoing tightness in the financial system. These measures however are likely to bring about a temporary effect. For long-term sustainability, restoration of normalcy in the credit market especially for NBFCs is critical. Additionally, development of alternative sources of financing such as an active securitisation market would be beneficial.

Actions to Complement System and Balance-sheet Liquidity:The RBI has recently infused INR320 billion of durable liquidity into the system and another INR240 billion is likely to come in the month of October 2018 through open market operations. In addition, to tide over frictional liquidity mismatches, banks are now permitted to reckon SLR securities held by them up to another 2% of their net demand and time liabilities, under the facility to avail liquidity for liquidity coverage ratio within the mandatory SLR requirement. Ind-Ra believes this will help in stabilising the systemic liquidity, especially in light of possible draining of liquidity in the upcoming festive session. SBI has announced an additional INR300 billion asset buyout from NBFCs, which would help them tide over the ongoing challenges.

Potential Source of Liquidity for NBFCs: Ind-Ra has analysed the top eight housing finance companies (HFCs; excluding HDFC Ltd and LIC Housing Finance Limited) and the top 10 non-infrastructure NBFCs. Of the total, 16 entities (are among the largest NBFCs) have about INR5 trillion exposures to asset classes that are preferred (most common are microfinance, commercial vehicles, housing loans etc) for assignment or securitisation. According to the announcement by SBI, it is expected to purchase over INR450 billion (about three times of normal buyouts) of assets from NBFCs over FY19 to create additional source of liquidity for non-banks. Some of the well-capitalised banks, many of which are approaching their sectoral cap on NBFCs, may also expand their buyouts of assets as an alternative to expand funding to non-banks.

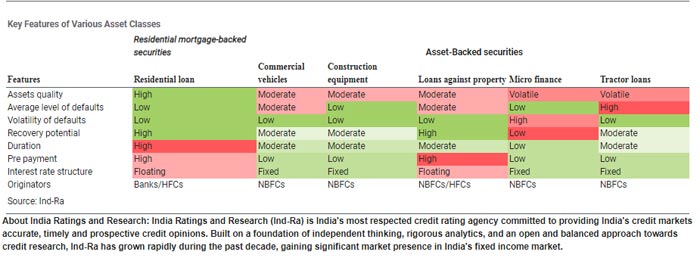

Banks can Cherry Pick Assets: As opposed to the asset classes which are typically securitised or assigned, originating granular housing loans, commercial vehicle loans and other such asset classes involves significant operating costs and banks may not have the adequate network to originate them or assess credit quality on a large scale. In the current environment, banks could cherry pick assets from NBFCs and price them well instead of originating them, thus avoiding scope for early delinquencies. This proposition is likely to result in better RoAs for banks on both priority sector lending qualifying assets and others that are securitised / assigned.

Ind-Ra also expects other banks (including private banks) with adequate capital buffers to use a similar strategy to cherry pick assets from NBFCs. Additionally, exposure to these assets does not amount to exposure to NBFCs’ balance sheet and hence this route partly addresses the perceived risk aversion. NBFCs will see some relief on the perception of inadequate liquidity over 3QFY19 and the securitisation push would be conducive for matching assets with liabilities. This is also an opportunity for NBFCs to reduce dependence on short-term funding, as they take some assets off the balance sheet.

Decelerating Credit Flows from Non-Banks: The recent data from mutual funds suggest that there has been a considerable drop in assets under management under liquidity fund in September (part of which is seasonal), after a sudden rise in August. Asset management companies have been the largest subscribers of money market instruments and have been instrumental for the surge in NBFCs’ business in the last few years. Overall, incremental inflows into debt funds have decelerated and therefore supply funding could be restricted. This scenario could not only impinge NBFCs’ growth but also pose refinancing challenges, especially for the newer and weaker NBFCs. In these circumstances, monetisation of assets through securitisation to address short-term financing requirements could be beneficial. The current situation also strengthens the necessity of developing a securitisation market for stakeholders to ensure a sustainable funding option along with traditional sources.

Happiest Minds brings in an innovative GenAI chatbot

Happiest Minds Technologies has announced the new GenAI chatbot - ‘hAPPI...

Government mandates encryption for CCTV cameras to ensure netw

In the wake of issuing an internal advisory on securing CCTV cameras at g...

TRAI recommends allowing only Indian entities to participate i

The Telecom Regulatory Authority of India (TRAI) has recommended that onl...

Galaxy AI is available on more devices with Samsung One UI 6.1

Samsung has expanded the range of smartphones to which One UI 6.1 and Gala...

Technology Icons Of India 2023: Aalok Kumar

Aalok continues to lead the India business and further strengthen Indi...

Technology Icons Of India 2023: Debjani Ghosh

Debjani Ghosh is the first woman president of NASSCOM (the umbrella bo...

Technology Icons Of India 2023: Dr. Sanjay Bahl

Sanjay Bahl is currently with the Indian Computer Emergency Response T...

ECIL continues to keep India ahead in the growth of Information Technology and Electronics

ECIL played a very significant role in the training and growth of high...

STPI encouraging software exports from India

Software Technology Parks of India (STPI) is an S&T organization under...

Aadhaar: Architecting the World's Largest Biometric Identity System

The Unique Identification Authority of India (UIDAI) is a statutory au...

TEXONIC INSTRUMENTS

Texonic has carved a niche for itself in the Technology Distribution i...

INFLOW TECHNOLOGIES PVT. LTD.

Inflow Technologies is a niche player in the IT Infrastructure Distrib...

FORTUNE MARKETING PVT. LTD.

Delhi based Fortune Marketing, An ISO 9001:2008 company, distributes ...