1 billion to cost recalibration of 2.4 lakh ATMs for new Rs 100 note

By MYBRANDBOOK

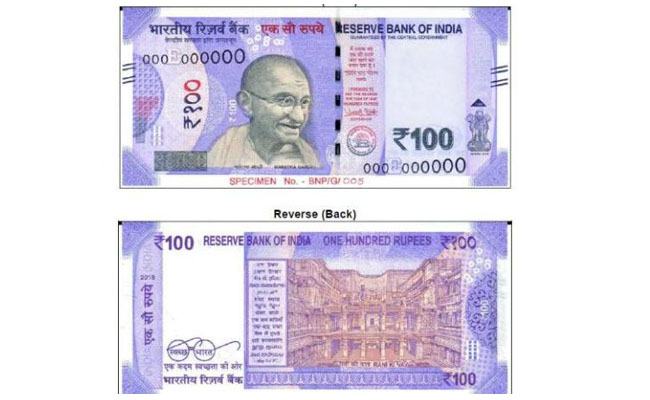

The Reserve Bank of India (RBI) had, on July 19, announced that the bank is planning to release a new lavender-coloured Rs 100 note which would have RBI Governor Urjit Patel’s signature on it. Now a question remain unanswered, concern is on striking a balance between the supply of new notes and withdrawal of the old ones. the report states that the process can take one year or more to complete. An official told the publication that the process will be carried out in phases.

This is the fifth new banknote size to be issued by the central bank since demonetisation in November 2016. The ATM industry is just about finishing the calibrating the ATMS for Rs 200 denomination. This recalibration would again require investment in terms of cost and efforts.The exercise of recalibration of the new Rs 100 note could take over Rs 100 crore and 12 months of time to completely recalibrate 2.4 lakh ATMs in the country.

Introduction of the indigenous note is a proud moment for the country and also for every Indian. The Reserve Bank of India's (RBI) announcement launching a new series of 100-rupee denomination notes has been greeted with trepidation by the major companies engaged in the manufacture and supply of Automatic Teller Machines (ATMs) in the country.

There are 237,000 ATMs (App.) in the country would again have to be re-calibrated to dispense the new Rs. 100 notes. This entails a massive effort with additional cost of 1 billion for recalibrating all the ATMs in the country to enable them dispense the new Rs. 100 notes, the operators need the concerned bank's official Cash Agency and an engineer of the machine manufacturer together and would take a minimum of one year to complete. In fact, the recalibration of the new Rs. 200 notes introduced last year is still not completed in all ATMs, so recalibration of the new Rs. 100 notes could take even longer unless planned properly.

The RBI said in its notification that initially, the new Rs 100 notes will be dispensed only through bank branches and printing and supply would gradually increase. Antony said it is important to have sufficient supply of Rs 100 and Rs 200 notes to ensure there are enough lower denomination currency notes in circulation for all transactions.

At present, as per National Payments Council of India Ltd (NPCIL), there are around 237,000 ATMs functional in the country, but to adequately cater to the entire country's population, the need is almost three-four times more, or around a million ATMs. As per official data, barely 30 per cent of bank account holders in the country regularly use their ATM cards and the others prefer cash transactions. There are problems of infrastructure and connectivity which hamper growth of ATMs network.

Legal Battle Over IT Act Intensifies Amid Musk’s India Plans

The outcome of the legal dispute between X Corp and the Indian government c...

Wipro inks 10-year deal with Phoenix Group's ReAssure UK worth

The agreement, executed through Wipro and its 100% subsidiary,...

Centre announces that DPDP Rules nearing Finalisation by April

The government seeks to refine the rules for robust data protection, ensuri...

Home Ministry cracks down on PoS agents in digital arrest scam

Digital arrest scams are a growing cybercrime where victims are coerced or ...

ICONS OF INDIA : SOM SATSANGI

With more than three decades in the IT Sector, Som is responsible for ...

ICONS OF INDIA : RAMESH NATRAJAN

Ramesh Natarajan, CEO of Redington Limited, on overcoming ‘technolog...

Icons Of India : Puneet Chandok

Puneet Chandok is President, Microsoft India & South Asia and is respo...

NSE - National Stock Exchange

NSE is the leading stock exchange in India....

IOCL - Indian Oil Corporation Ltd.

IOCL is India’s largest oil refining and marketing company ...

RailTel Corporation of India Limited

RailTel is a leading telecommunications infrastructure provider in Ind...

Indian Tech Talent Excelling The Tech World - Satya Nadella, Chairman & CEO- Microsoft

Satya Nadella, the Chairman and CEO of Microsoft, recently emphasized ...

Indian Tech Talent Excelling The Tech World - Steve Sanghi, Executive Chair, Microchip

Steve Sanghi, the Executive Chair of Microchip Technology, has been a ...

Indian Tech Talent Excelling The Tech World - NEAL MOHAN, CEO - Youtube

Neal Mohan, the CEO of YouTube, has a bold vision for the platform’s...

of images belongs to the respective copyright holders

of images belongs to the respective copyright holders