Indian FinTech Industry: At An Inflexion Point

By MYBRANDBOOK

RBI has been instrumental in enabling the development of fintech sector and is espousing a cautious approach in addressing concerns around consumer protection and law enforcement

FinTech or financial technologies is one of the fastest-growing areas in banking and financial services and also one of the fastest-growing sectors in the country. It may be defined as technology-driven financial businesses that compete against as well as complement the traditional financial institutions. FinTech is making the experience of banking and finance more intuitive, personalized and empowering. .

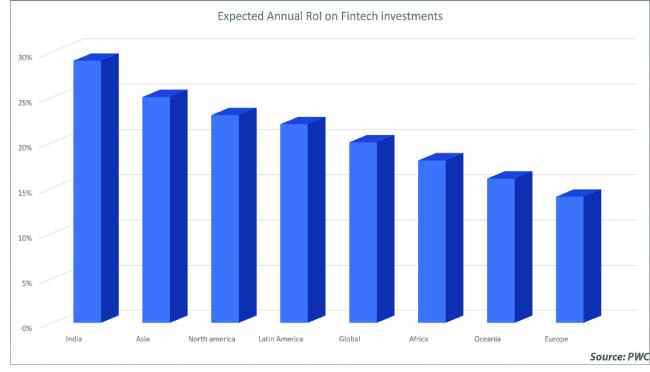

According to a Deloitte study, the Indian fintech industry is among the top five markets in India in terms of value of capital funding and investments. The industry grew from nearly $270 million of funding in 2016 to $2.4 billion in 2017. Viewed in the context of 2016 global figures where USA managed to get $6.2 billion in 2016 and $11.3 billion in 2017, India’s jump shows the confidence that India has managed to get the VCs in its side. There are more than 1,200 fintech companies operating in the country currently. According to EY Fintech Adoption Index, India has the second-highest fintech adoption rate of 59%, significantly higher than global average of 33%. The global fintech software and services sector is expected to boom as a $45-billion opportunity by 2020, growing at a compounded annual growth rate of 7.1% – as per NASSCOM, while the Indian fintech software market is forecasted to touch $2.4 billion by 2020 from a current $1.2 billion.

India remains one of the largest markets where the structural enablers to set up and incubate fintech have come together strongly and at an apt time. Combination of steady economic growth with low penetration of financial services and availability of supporting infrastructure such as internet data access, smartphones along with utility infrastructure including Aadhaar-based authentication are likely to provide the required impetus to India’s fintech sector.

The year 2015 was a formative year for the Indian fintech sector, which saw the emergence of numerous fintech startups, incubators and investments from public and private investors. It was clearly reflected that a right mix of technical skills, capital investments, government policies, regulatory framework and entrepreneurial and innovative mind-set could be the driving force to establish fintech as a key enabler for financial services in India.

Some of the sectors within the fintech space such as next-generation payments and financial inclusion are quite mature in India in terms of fintech startup ecosystems, government regulations and steps taken by the incumbent market participants. While P2P lending, robo advisory, Bank in a Box, security and biometrics are striding fast towards mass market implementation, blockchain has just marked its entry with a promising future in the financial services arena.

The traditionally cash-driven Indian economy has responded well to the fintech opportunity, primarily triggered by a surge in e-commerce, and smartphone penetration. A report titled “Digital Payments 2020” by BCG and Google predicts that digital transaction in India will exceed $100 billion in 2020, up from $40 billion in 2016.

Growth Drivers

It is always the government that plays the most crucial role in the growth of any country’s financial industry. The Government of India, along with regulators such as SEBI and RBI, is aggressively supporting the ambition of the Indian economy to become a cashless digital economy and emerge as a strong fintech ecosystem via both funding and promotional initiatives.

Some the government initiatives like Start-Up India and Jan Dhan Yojana which have added over 200 million unbanked individuals into the banking sector and Aadhaar for easy and secure KYC are the key enabling factors.

These efforts along with tax-related incentives like tax rebates for merchants for digital transactions, rebates on patent costs for startups, income-tax exemption for startups for the first three years, exemption on capital gains tax for investments in unlisted companies for longer than 24 months (from 36 months needed earlier), no surcharge on online and card payments for availing of government services, are also helping in pushing towards creating more startups in the fintech space.

RBI has also been instrumental in enabling the development of fintech sector and espousing a cautious approach in addressing concerns around consumer protection and law enforcement. Fintech enablement in India has been seen primarily across payments, lending, security / biometrics and wealth management.

Some of the initiatives from the central bank like introduction of “Unified Payment Interface” with NPCI, approval to 11 entities for setting up Payments Bank and approval to 10 entities for setting up Small Finance Banks that can significantly run in favour of the cause for Financial Inclusion.

Another important factor in fast adoption of digital transactions in particular and fintech in general has been the launch of 4G services by Reliance Industries under the brand name Jio. Jio disrupted the market and within a year of its launch it pushed India from the bottom of the pyramid to amongst the top in terms of internet penetration. Data prices are at the lowest across players and speeds have gone up drastically (though still very low compared to developed economies).

Besides, one of the major developments that propelled the adoption of digital transactions in India was demonetization. During the end of 2016, the Prime Minister announced that the large denomination currency notes, i.e. Rs.1,000 and Rs.500, will no more be considered as legal tenders, means these notes are banned. In the subsequent months, Indians faced hardships in doing cash transactions which led to mass adoption of mobile wallets like Paytm, FreeCharge and MobiKwik.

Indian fintech industry is empowered by multiple technology-driven payment and transaction solutions. These segments are at different stages of growth and maturity within India and across the world. Here is a look at how different segments are poised as on date.

Mobile Wallets

The mobile payment industry in India was valued at about $1.15 billion in 2016, growing from US$86 million in 2011, clocking at CAGR of 68%. But demonetization of high-value notes in India in late 2016 propelled the industry clock to unprecedented numbers. A month after demonetization, daily transaction volume from digital wallets – such as Oxigen, Paytm and MobiKwik – went up by 271%, from 1.7 million to 6.3 million. And while those adoption figures have fluctuated up and down a bit over the last 18 months, the trend has been towards growth.

Entry of global players into India’s digital payment space is expected to grow the segment by about five-fold to US$1 trillion by 2023, investment banking firm Credit Suisse said in a report. The report also said that, unlike China, mobile payments in India are being built on public infrastructure like UPI and Aadhaar that allow open-architecture and an interoperable payment system to evolve.

“With 800 million bank accounts now linked to mobile, existing bank accounts should be mobile-transaction ready. We believe that the top four banks (SBI, HDFC Bank, ICICI, Axis) are better placed as the aggregators are expected to look to tie up with these franchises, given they account for about 50–70% of non-cash transactions,” the report said.

The Credit Suisse report said that there is also no loss of customers for the banks even as they transact on the platforms of these aggregators, and the banks would gain access to customer data. As of December 2017, transactions worth Rs.12,568 crore ($1.93 billion) were carried out on e-wallets, according to RBI – a nearly fourfold increase from the Rs.3,385 crore in October 2016, before demonetization kicked off. If that growth remains consistent, estimates put the total value of India’s digital payments at US$500 billion in just two years – or roughly 15% of India’s GDP.

UPI

Unified Payments Interface (UPI), launched in August 2016, has been a game-changer. It has seen quick market adoption and almost all banks have already adopted this new protocol and even players like WhatsApp, the most widely used messaging app in the country, has recently started rolling out a UPI-based payments feature.

Other global giants, too, are zeroing in on this space. For instance, Google has already launched its payments app Google Tez, and in just four months of launch it is already processing the same number of digital transactions as Axis Bank (fourth-largest among banks in India). Samsung has launched Samsung Pay and Amazon has introduced Amazon Pay. While both Google Tez and Samsung Pay have been UPI-enabled for the past few months, Amazon Pay introduced the UPI feature earlier this week. Apple, too, is looking to introduce Apple Pay in the country in the near future.

Microsoft is also planning to launch its own digital payment service which will be integrated with its enterprise social network platform Kaizala. The integration will take care of payments from wallet to wallet, bank to bank, credit card to bank and vice versa.

Meanwhile homegrown digital payment firms like Paytm, PhonePe, MobiKwik and FreeCharge (all are UPI-enabled) are strengthening their arsenal. Paytm, India’s largest online payments and mobile wallet company, has invested Rs.5,000 crore ($786 million) in mobile payments, to date. Paytm founder Vijay Shekhar Sharma has earmarked another Rs.5,000 crore for the next three years.

PhonePe, the digital payment arm of India’s leading e-tailer Flipkart, is planning to invest $500 million to scale up its technology platform and expand its merchant network and consumer base.

Many other startups have entered the space to simplify mobile money transfer, such as Chillr application, which provides peer-to-peer money transfer without using bank account details. Some of the leading Indian banks are leveraging the Chillr platform for P2P payments.

Several leading banks are launching their own digital wallets leveraging NPCI’s Immediate Payment Service (IMPS) platform. These digital wallets are integrated with social media features. Few examples are Buddy by SBI and LIME by Axis. Similarly, few banks are going for payment solutions enabling money transfer, P2P transfer, etc for smartphone users, such as PingPay and PayZ app.

Google Pay

After years of experimenting in the payment space with products like Android Pay and the now rebranded Google Wallet, Google this week announced the launch of its latest all-in-one payment platform: Google Pay. The new product, which has begun roll-out around the world, replaces Android Pay and allows users to make Point of Sale (PoS) purchases of goods and services – as well as transit payments in select cities – using NFC (Near Field Communication).

Apple Pay

First unveiled at the iPhone 6 launch in September 2016, Apple Pay was among the first payment platforms to digitise the ubiquitousness of credit and debit cards. Developed through a collaboration with Visa, MasterCard, and American Express, Apple’s payment service can be used with any of the tech brand’s compatible mobile devices or Watch wearables, and makes use of NFC to make contactless payments at PoS systems.

Samsung Pay

Samsung’s mobile payment and digital wallet service, Samsung Pay, differs from those offered by Apple and Google in one key aspect: the use of magnetic secure transmission (MST) in addition to NFC. What this means is that, unlike Google Pay or Apple Pay which can only be used at NFC-enabled PoS devices, Samsung Pay can be used even at payment terminals that only support traditional magnetic stripe cards.It is supported by a wide range of Samsung smartphones as well as most of its smartwatches.

AliPay

The Alibaba Group, a Chinese conglomerate which is today among the world’s most valuable companies, also owns the world’s largest online and mobile payments platform: Alipay Launched way back in 2004, the platform today features every payment service imaginable – P2P payments, online purchasing, bank account management, ticket purchases, etc., – and recently incorporated the Ripple network into its backend in a bid to speed up its payment processes.

Facebook payments (Messenger and WhatsApp)

Facebook first entered the online payments space in 2015 with the introduction of a peer-to-peer payment services within its Messenger app. The company was initially slow in rolling out the platform to markets outside the US, with several countries still awaiting the availability of the feature. Facebook’s entry into the Indian digital payments sector came through its subsidiary WhatsApp, by far the most used messaging service in the country. The 250-million-user strong platform recently launched its own UPI-enabled payments service.

PayPal

PayPal is world’s first online payments companies and has established has a strong global presence over the years. The company – which allows users to send, receive, and hold funds – operates in 202 markets supporting 25 currencies (as of 2017. The key factor in PayPal’s success is Venmo, a P2P mobile payments service that, despite operating solely in the US, handled $6.8 billion in transactions in the first quarter of 2017. The company has also created a payments processing system called PayPal Payments Pro which is widely used by online businesses and enterprises for large transactions.

Paytm

Launched in 2010 in India as a service for online payments and a digital wallet, Paytm is today a diverse company offering a variety of services. Paytm(part of One97 communications) is arguably the largest digital service used for merchant payments in India, in large part due to the demonetisation of 2016. Many of the country’s service-based startups have incorporated Paytm as a payment option, and the app itself can be used for everything from prepaid recharges to bill and loan payments, ticket purchases to P2P money transfers, and even donations to religious foundations. The Alibaba Group and its subsidiary Ant Financial are key investors in One97 communications and hold 62 percent stake in the firm.

MobiKwik

MobiKwik is an Indian company founded in 2009 that provides a mobile phone based payment system and digital wallet.Customers add money to an online wallet that can be used for payments.MobiKwik claims as the most convenient, and safest mobile wallet for Shopping, Mobile recharge, DTH recharge, Money transfers and Bill payments. 25 million users base across the across the country.

BBPS

Another important thing to have happened in 2017 was the launch of Bharat Bill Payment System (BBPS) which nearly doubled the number of bills paid through the platform in December 2017 to 19 million transactions from 10 million in April, when the pilot was launched, KPMG in its report on BBPS has highlighted. BBPS, is touted to become a one-stop bill payment solution for Indian consumers, the initial achievements of the platform and its potential given that it has already integrated 60 billers.

The value of bills paid on the platform jumped about 46% to Rs.2,690 crore in December 2017 from Rs.1,843 crore in April. This was, however, still a very small share of the overall bill payments market, which is projected to grow to Rs.9.4 lakh crore by 2020 from Rs.5.8 lakh crore in 2016.

The Reserve Bank of India (“RBI”) has given in-principle approval to 33 entities, which had applied for operating as a Bharat Bill Payment Operating Unit (“BBPOU”) under the Bharat Bill Payment System (“BBPS”). BBPS is an integrated bill payment system which would offer interoperable bill payment service to customers online as well as through a network of agents on the ground.

The future of payment is undergoing a transformation, as new entrants are enabling the market with new technologies such as contactless payment, NFC-enabled smartphones, cloud-based PoS and digital wallets.

Payments Bank

One more financial service that was introduced by the government was Payments Banks. In 2014, the RBI gave in-principle approval to 11 entities to offer payments bank services and the first licence offered was to Bharti Airtel. What a payments bank does is it offers small- ticket financial services, including opening of savings bank accounts, money transfer, make bill payments using that savings account and earn interest on the deposited money. Its like any other bank with only exception that the payments banks are not allowed to offer credit services like loans or credit card.

Airtel Payments Bank, India Post Payments Bank, Vodafone M-Pesa Payments Bank, Reliance Jio Payments Bank, etc are some of the examples of this new-age banking solutions offered by entities that are traditionally not into banking services.

“According to the EY FinTech Adoption Index 2017, money transfer and payments as a sub-domain has the highest consumer adoption rate globally at 50%, with India leading the way at an impressive 72%.”

Robo-advisory

Robo advisory, a kind of artificial intelligence-driven financial service, is an emerging area of wealth advisory services. These services help customers take informed and comparatively wiser financial decisions. Robo Advisors are basically AI-based solutions. Their advice is data-driven and free from personal biases, their fees are reasonable, and they’re always available to provide clients with real-time access to solutions and reports in just a few clicks.

On a global basis, the robo advisory service is projected to grow at CAGR of 68% over the next five years and manage $5 trillion worth of assets by 2025.

FundsIndia is one of the most successful robo-advisory startups and early adopters of this technology. Its AUM (asset under management) has risen from Rs.187 crore in 2012 to Rs.3,000 crore ($460 million) in 2016. Further, it is expected to reach Rs.10,000 crore ($1.5 billion) within the next 18 months. Many new entrants and traditional broking firms have launched robo advisory services in India such as Aditya Birla Money’s MyUniverse, BigDecision, ScripBox, Arthayantra, FundsIndia and 5nance

P2P Lending

The global market for P2P lending is expected to grow at a CAGR of 60% to US$1 trillion by 2025 from US$9 billion in 2014, with the U.S., the U.K., Australia and China being the largest P2P lending markets. According to a recent report by PwC, India has around 30 online lending platforms with a loan book pegged at $25 million. In the next five years, India is expected to grow by 160 times to reach the $4-billion mark. But this is nothing when compared to China, which currently stands at a $100-billion mark.

In India, the P2P lenders broadly focus their portfolio under the categories of micro finance, consumer loans and commercial loans. For example, 30% of Faircent’s loans are taken by micro and SME sectors, boutique firms and mom-and-pop stores. The rest are taken by individuals for private purposes such as weddings, medical and home.

Some of the other leading P2P lenders in India are i2ifunding, Loanmeet, i-lend, LendenClub, Milaap, MicroGraam, InstaPaisa, Vote4Cash, etc.

The growth potential of the market in India is huge as there are about 57.7 million small businesses in the country. Currently, in the absence of a regulatory framework, Indian P2P startups are registered under the Companies Act and abide by the Negotiable Instruments Act.

RBI recently released a consultation paper on P2P lending business model where companies need to be registered as a special category NBFC and spoke about six prime areas including permitted activity, reporting, prudential and governance requirements, business continuity planning and customer interface, thereby providing an approach to curtail the risk in this sector. The idea is to bring the P2P lending platforms within the scope of NBFC governance.

Recently India’s leading peer-to-peer lending companies have come together to form the Association of P2P Lending Platforms. The first-of-its-kind association will act as a representative for its members, as well as the country’s P2P lending industry. In addition, the association will work in conjunction with the government and regulatory authorities in matters of compliance, and to further the cause of financial inclusion in the country.

Moving forward, we believe that technology convergence is likely to make P2P lending safer and faster. UPI and blockchain are two big technology revolutions that are projected to have a favourable impact on the expansion of P2P lending business in India. With an intent to have a robust P2P market, the government of India has to address certain key areas for P2P lenders such as on capital structure, requirement of fund for lender protection, process of transfer of money and infrastructure needs and making sure that objective of introductory regulations is to control the unruly practices rather than posing barriers for fintech adoption in the country.

The two big mobile wallet firms – Paytm and MobiKwik – are also planning to start their P2P lending platforms, and the former has already sought a licence from the RBI for the same.

Blockchain

Although blockchain has been in existence since 2009, it garnered mixed reviews from the industry in its early years. It has now been taken up as a new innovative model globally. Blockchain can be defined as a way of initiating and verifying transactions in a distributed environment. The decentralized record-keeping and reporting functionalities promise opportunities in reducing cost, fraud and increasing speed of transactions. With initiatives such as R3 CEV, leading banks are battling their way for developing blockchain applications, thereby enabling a change in the traditional financial systems.

Overall, the global investment in blockchain has exceeded US$1 billion in over a thousand startups and is expected to increase four-fold by 2019, growing at a CAGR of 250%. A notable example is the funding received by Coinbase and Circle exceeding US$240 million in 2015. Blockchain is being perceived in India as a game-changer that, if used to its full potential, can offer an innocuous, quick and economical way for transactions. Though it is at a very nascent stage and is yet to mature into a mainstream application, the technology is receiving encouraging reviews from market players in the country.

InterGlobe’s Rahul Bhatia and C.P. Gurnani together announce

In a move that is set to transform the AI landscape, Rahul Bhatia, Group M...

Download masked Aadhaar to improve privacy

Download a masked Aadhaar from UIDAI to improve privacy. Select masking w...

Sterlite Technologies' Rs 145 crore claim against BSNL rejecte

An arbitrator has rejected broadband technology company Sterlite Technolog...

ID-REDACT® ensures full compliance with the DPDP Act for Indi

Data Safeguard India Pvt Ltd, a wholly-owned subsidiary of Data Safeguard ...

Technology Icons Of India 2023: Lt Gen (Dr.) Rajesh Pant (Retd.)

LT Gen(Dr.) Rajesh Panth (Retd.), National cyber security coordination...

Technology Icons Of India 2023: Aalok Kumar

Aalok continues to lead the India business and further strengthen Indi...

Technology Icons Of India 2023: Ashwini Vaishnaw

Ashwini Vaishnaw is an Indian politician and former IAS officer and is...

TCIL continues to strengthen India with its technology expertise

TCIL undertakes consultancy & turnkey projects in the field of Telecom...

Leading company into fertilizers in the country

NFL is a dynamic organization committed to serve the farming community...

EESL encouraging e-mobility adoption across India

Energy Efficiency Services Limited (EESL) is a Super Energy Service Co...

ADITYA INFOTECH LTD.

Aditya Infotech Ltd. (AIL) – the technology arm of Aditya Group, is ...

TEXONIC INSTRUMENTS

Texonic has carved a niche for itself in the Technology Distribution i...

IVALUE INFOSOLUTIONS PVT. LTD.

: iValue Info Solutions is a value added distributor, provides solutio...