Mrutyunjay Mahapatra, DMD, Digital Business and New Business-SBI

By MYBRANDBOOK

‘A CIO’s role does not pertain to just running day-to-day IT functions’

Digital Disruptions are no more topics of seminars and newspaper articles. It has landed with a bang in the lives of individuals, enterprises and societies. The power of digital things - whether in networking, mobility, cloud or social media, is changing the way business is done and the way individuals & organizations meet, exchange & deliver value. Technologies are rapid and speed is often blinding. It is important to understand this three dimensional attack around complexity, velocity and variety.

Banks and Financial sector players are traditionally cautious and many in India are critically vendor dependent. For example, the adaptation of cloud, simply a matter of time, could unrecognizably alter the procurement, provision and use of hardware. Datacenters of racks of servers will be rendered redundant with Capex turning into Opex. In another example, the payments space with authentication and application of RPA & AI could become so seamless that Banks payment gateways & payment systems have to be thrown out to be replaced by user centric and social & mass media based product deliveries.

In today’s world, user experience and user self-service have become a main anchor of competitive advantage. This enjoins a lot of work on Platformization and Enterprise integration initiatives like API building. Banks like SBI are also setting up UX centres, Collaboration Labs and Innovation framework. The results of these initiatives will be the main ammunition with which marketing warfare shall be conducted.

All these challenges have made the lives of all players, enterprises, vendors and employees very grueling and pressure cooker like, but without a doubt multiple times more interesting and exciting.

Banks and Financial sector players are traditionally cautious and many in India are critically vendor dependent. For example, the adaptation of cloud, simply a matter of time, could unrecognizably alter the procurement, provision and use of hardware. Datacenters of racks of servers will be rendered redundant with Capex turning into Opex. In another example, the payments space with authentication and application of RPA & AI could become so seamless that Banks payment gateways & payment systems have to be thrown out to be replaced by user centric and social & mass media based product deliveries.

Legal Battle Over IT Act Intensifies Amid Musk’s India Plans

The outcome of the legal dispute between X Corp and the Indian government c...

Wipro inks 10-year deal with Phoenix Group's ReAssure UK worth

The agreement, executed through Wipro and its 100% subsidiary,...

Centre announces that DPDP Rules nearing Finalisation by April

The government seeks to refine the rules for robust data protection, ensuri...

Home Ministry cracks down on PoS agents in digital arrest scam

Digital arrest scams are a growing cybercrime where victims are coerced or ...

Icons Of India : Arundhati Bhattacharya

Arundhati Bhattacharya serves as the Chairperson and CEO of Salesforce...

ICONS OF INDIA : VIJAY SHEKHAR SHARMA

Vijay Shekhar Sharma is an Indian technology entrepreneur and multimil...

ICONS OF INDIA : SANJAY GUPTA

Sanjay Gupta is the Country Head and Vice President of Google India an...

GeM - Government e Marketplace

GeM is to facilitate the procurement of goods and services by various ...

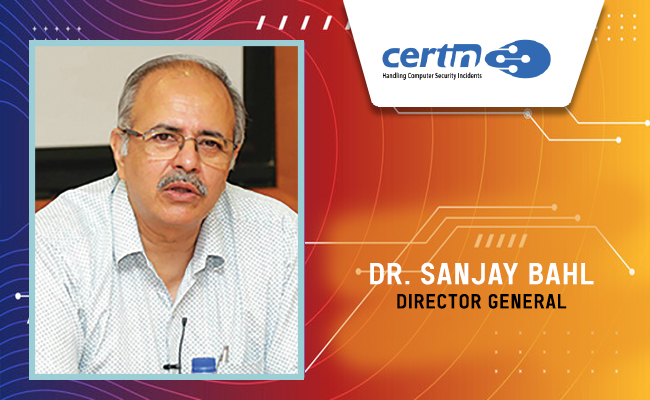

CERT-IN - Indian Computer Emergency Response Team

CERT-In is a national nodal agency for responding to computer security...

DRDO - Defence Research and Development Organisation

DRDO responsible for the development of technology for use by the mili...

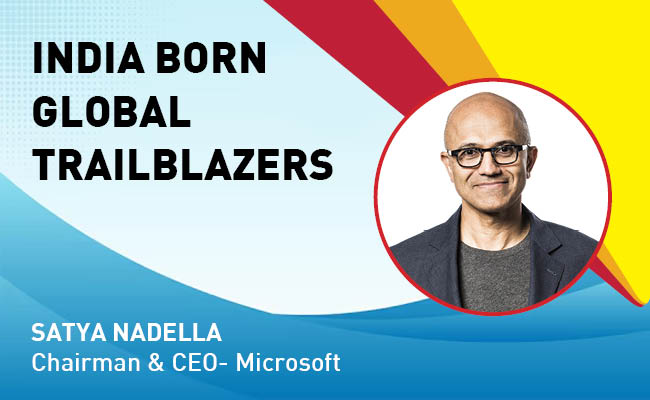

Indian Tech Talent Excelling The Tech World - Satya Nadella, Chairman & CEO- Microsoft

Satya Nadella, the Chairman and CEO of Microsoft, recently emphasized ...

Indian Tech Talent Excelling The Tech World - Rajiv Ramaswami, President & CEO, Nutanix Technologies

Rajiv Ramaswami, President and CEO of Nutanix, brings over 30 years of...

Indian Tech Talent Excelling The Tech World - Steve Sanghi, Executive Chair, Microchip

Steve Sanghi, the Executive Chair of Microchip Technology, has been a ...

of images belongs to the respective copyright holders

of images belongs to the respective copyright holders