IoT Industry : The New Frontier

By MYBRANDBOOK

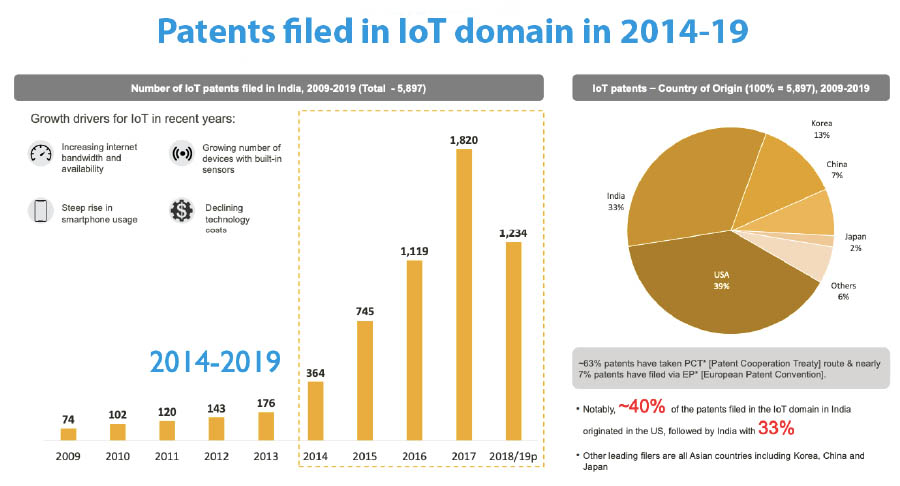

India is gradually becoming the hub of IoT innovations with more than 5000 patents filed in last 5 years and the industry is going to get another shot in the arm because of COVID-19 norms that prompt for remote working and contactless activities

Though the Internet of Things (IoT) appears to be a new addition to the changing technology dynamics in India, it has permeated to almost every industry at a rapid pace in the last couple of years. Gradually, India is turning out to be the hub of IoT innovations and deployments in Asia. From manufacturing to transportation to utilities to consumers, the technology solutions are being deployed in these industries in some form or the other on a consistent fashion. While Industry 4.0 saw big ticket IoT deployments last year, the consumer and construction vertical saw the maximum number of deployments on volume basis.

Some of the major factors that are driving the growth include a huge market size, a vibrant startup ecosystem, conducive government policies, robust digital infrastructure and a massive technical talent pool. Both industrial IoT (IIoT) and Consumer IoT are seeing significant traction in last couple of years on account of these factors.

Market Dynamics

According to a Nasscom-Deloitte study, the global IoT market is poised to be a $328 billion market by 2020 and India could take a $15 billion share of that accounting to 5% of the global market. This estimate makes sense when we look at India’s ambition of being a $1 trillion digital economy by 2025 which will be driven by technologies like machine learning, artificial intelligence, IoT and cyber security. In addition to that the Government of India’s multi-billion-dollar investment in building 100 smart cities is also driving the growth of IoT in India.

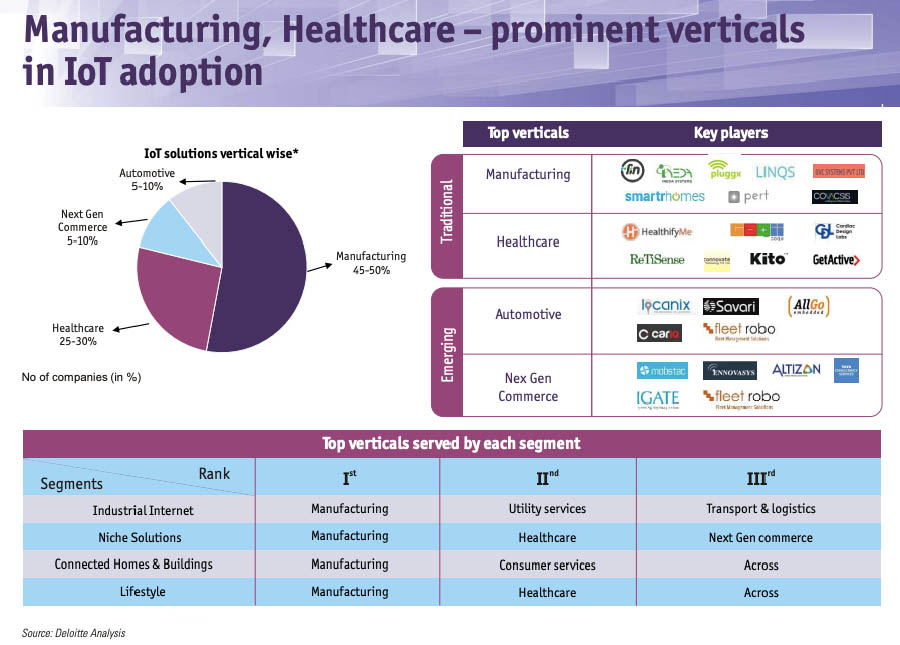

By end of 2019, India had 200-250 million connected devices, as per research firm Zinnov. The firm estimates that this number will grow tenfold to touch 2 billion devices by 2021, signalling the exponential market growth in the next few years. In fact, IoT adoption has exploded in the last 3 years, with enterprises spending billions of dollars in testing and deploying several IoT use cases. A large part of this spend - about 60-70% - is comprised of software and hardware products, while the rest is on services. Manufacturing, automotive & transportation, and energy & utilities are the top 3 verticals driving investments in IoT.

Five key segments are contributing to the overall IoT market demand in India - large enterprises, global capability centers (GCCs), small and medium businesses (SMBs), consumers, and the government. There are over 1200 public-listed Large Enterprises in India, with a current IoT adoption rate of around 35%. The base of 1400+ GCCs is further propelling the IoT segment in India and these GCCs are rapidly testing, implementing, and scaling IoT technologies and use cases.

With more than 75 million SMBs, India has the second highest base of SMBs in the world. About 50,000 of these leverage some form of advanced digital technology solutions for driving business operations, including Artificial Intelligence (AI), Cloud, IoT, etc. These burgeoning segments, coupled with the increasing connectivity and smartphone penetration across the country, is driving the adoption of IoT-based solutions in the consumer segment. The Indian Government is also driving large-scale initiatives such as the Smart Cities project with a budget outlay of $31 billion between 2015 and 2022.

Besides, startups are driving the IoT dynamics in the country in a big way. There are over 1000 startups of IoT in India and Bangalore-the hotbed for IoT holds 51% of total IoT startups.

One more interesting aspect about the Indian IoT ecosystem is the number of patents being filed in this space. As per a Nasscom study, more than 5000 patents were filed in India in the last five years and 40% of these patent filings have already been granted. Of these, 40% of the patents in the IoT domain were filed from the US followed by 33% from India. This shows the push that the companies and startups involved are giving to IoT.

Driving Factors

According to Zinnov, Industry 4.0 or Smart Manufacturing and Connected Assets are two most prominent categories with 20-25% of investments directed towards each of these. Spends on Connected Products and Connected Logistics account for 15-20% each, with the share of Connected Workers accounting for 5-6%. In the case of Industry 4.0, the focus is on digitalization of individual factories for enhanced throughput and quality on the shop floor, which is then scaled as multi-factory deployments for higher enterprise-level efficiencies. Connected Assets use cases revolve around real-time operational intelligence and predictive maintenance of assets, while Connected Products is about building intelligent products to derive insights such as performance, usage patterns, personalized recommendations, etc. Connected Logistics focuses on reducing supply chain friction and Connected Workers category comprises of use cases around worker safety, AR-assisted operations, etc., Zinnov’s analysis further revealed.

Zinnov shared that a staggering 55% of these GCCs are working on IoT, while nearly 50% of the 35 major global IoT platform companies have engineering centers in India. IoT is clearly a priority for some of the largest GCCs in India, with even technology giants have made significant investments on IoT; in many cases, the global IoT programs are being driven from India.

The Zinnov study also disclosed that India is one of the richest talent ecosystems for IoT, with 30-40K professionals dedicatedly working on this technology. With 25-30%, Bangalore tops the IoT talent pool, followed by Mumbai and Delhi-NCR at 10-15% each. This talent is spread across GCCs, Service Providers, and enterprises, and ranges from software developers to hardware engineers, AI/ML experts, to IoT security professionals, required for any successful IoT deployment.

Outlook

The outlook of the Indian IoT market looks very promising as both the industrial IoT and consumer IoT are staring at more innovations and solution deployments in the post Covid-era.

While industries would look at integrating block chain, AI and machine language into business processes, the consumer counterpart would look at innovations that can make homes, residential and commercial complexes more connected and efficient.

The Covid-pandemic has opened up new areas for IoT deployments as it directly demanded ‘no or less-human intervention’ so as to keep the infection levels low. The Covid-19 has, in a way, promoted multifold actions around modernizing healthcare, public safety and security, disaster prevention and manufacturing and supply chain.

Devices like connected thermometers, smart wearables and advanced data collection and processing would boost telehealth and remote patient monitoring during such crises. Tracking health conditions of people who are entering public areas like markets, commercial spaces, restaurants and airports would boost sensor-driven solutions in coming times.

In terms of disaster management IoT can help geographic information system (GIS) overlaid on mobile data thus assisting epidemiologists in their search for patient zero. It can also help in identifying the infected contacts and deploy effective Quarantine Compliance through Smart Cellular Wrist Bands or other such wearables.

The country saw a disruption in its business activities because of lockdown-induced restricted movements. Supply chain and logistics machinery was left defunct during the time. IoT can help location tracking to track the movement of goods as well as workers. It will also help efficient supply chain management through smart devices and mobile sensors for better inventory management and demand forecasting.

Happiest Minds brings in an innovative GenAI chatbot

Happiest Minds Technologies has announced the new GenAI chatbot - ‘hAPPI...

Government mandates encryption for CCTV cameras to ensure netw

In the wake of issuing an internal advisory on securing CCTV cameras at g...

TRAI recommends allowing only Indian entities to participate i

The Telecom Regulatory Authority of India (TRAI) has recommended that onl...

Galaxy AI is available on more devices with Samsung One UI 6.1

Samsung has expanded the range of smartphones to which One UI 6.1 and Gala...

Technology Icons Of India 2023: Ajit Balakrishnan

The Company markets specific channels, community features, local langu...

Technology Icons Of India 2023: Lt Gen (Dr.) Rajesh Pant (Retd.)

LT Gen(Dr.) Rajesh Panth (Retd.), National cyber security coordination...

Technology Icons Of India 2023: Dr. P D Vaghela

Dr PD Vaghela serves as the Chairperson of Telecommunications Regulato...

ITI Limited widening its focus area

ITI Limited is a public sector undertaking company, has manufacturing ...

HPCL is transforming the energy landscape, across the nation and beyond

HPCL is world-class energy company known for caring and delighting the...

Aadhaar: Architecting the World's Largest Biometric Identity System

The Unique Identification Authority of India (UIDAI) is a statutory au...

SATCOM INFOTECH PVT. LTD.

Satcom Infotech Pvt. Ltd is a distribution houses in security in India...

SAVEX TECHNOLOGIES PVT. LTD.

Savex Technologies is the 3rd largest Information & Communication Tec...

RAH INFOTECH

RAH Infotech is India’s fastest growing technology value added dist...