E-Commerce Industry : The Best Is Yet To Come

By MYBRANDBOOK

While the e-commerce industry has seen phenomenal growth in the last couple of years on account of increased investments and digital transformation, the COVID-19 outbreak is going to push it further in FY2021-22

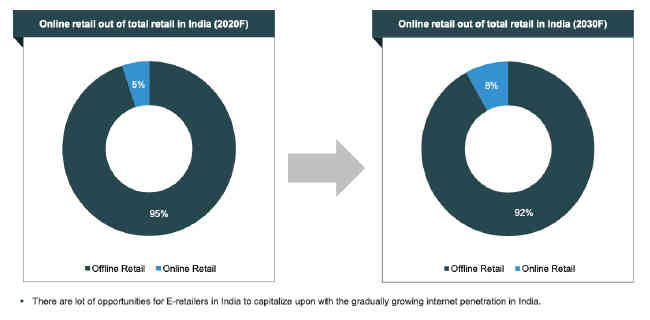

E-commerce in India has witnessed phenomenal traction in the last few years on account of multiple factors, the most important one being the ease of doing commerce. A pan-India internet connectivity, affordable access devices including smartphones and computers, a huge number of marketplaces and ease of sending or receiving money through digital payment solutions are the key factors that brought a tsunami of consumers flocking to doing the electronic mode of commerce. Similarly, from the business point of view, a mammoth consumer base and favourable e-commerce policies including that related to FDI have helped many multinational and Indian firms thriving in the Indian e-commerce space.

According to multiple reports, the Indian E-commerce industry has been on an upward growth trajectory and is expected to surpass the US to become the second largest E-commerce market in the world by 2034.

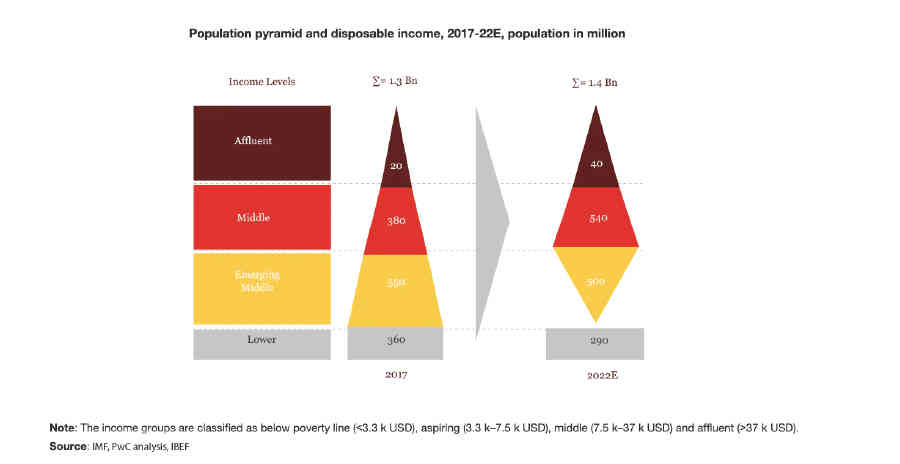

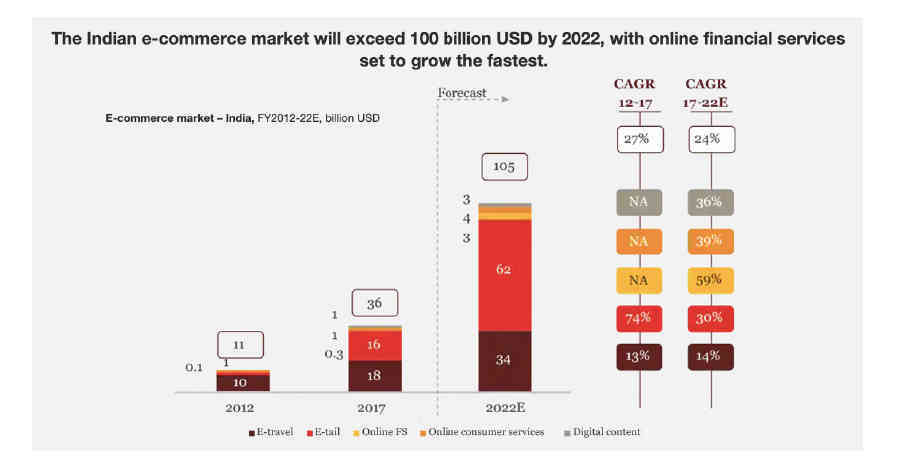

Market Size

According to IBEF, the Indian E-commerce market is expected to grow to $ 200 billion by 2026 from $ 38.5 billion as of 2017. In 2018, it reached $54 billion and by end of 2019 the market grew to touch $71.3 billion. As per GlobalData, one more research agency on various market trends, India would see an upward growth in its e-commerce business on account of Covid-19 outbreak as people would continue to prefer online shopping rather than visiting physical stores.

The e-commerce market in India is set to grow at a CAGR of 19.6% between 2019-2023, forecasts the GlobalData report. In the next two years, reports suggest, Indian ecommerce market size could swell to touch $150 billion on account of multiple growth drivers.

The market is primarily dominated by Flipkart, Amazon and PayTm Mall in multi-commodity market place and is equally crowded by other ecommerce players in various segments like fashion, grocery, food deliver, furniture etc.

In 2019, Indian online shoppers spent Rs 12,800 ($ 183.14) per shopper per year and this number is expected to rise to Rs 25,138 ($ 359.67) by FY30, according to IBEF. Mobile-savvy shoppers are the backbone of India’s online shopping industry with one in every three Indian shopped via a smartphone in 2019. It has been noticed that men have been a more avid shopper on the mobile platform compared to women, in part because of demographics and cultural differences.

Growth Drivers

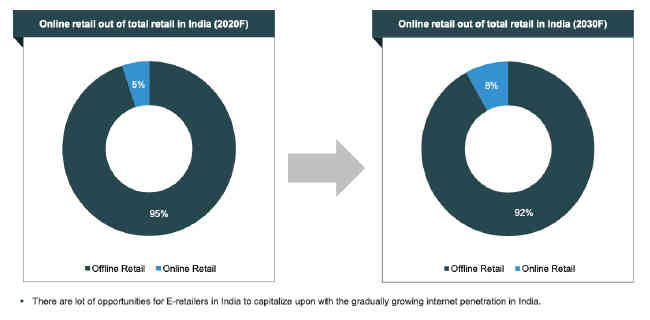

There are multiple factors driving the growth of e-commerce in India. Access to products and commodities at any place, any time through digital market places and smartphones and access to cashless transaction are among the biggest factors. And this factor is gaining strength each passing year with the smartphones and internet penetration increasing at a much higher pace than was earlier anticipated.

The ongoing digital transformation in the country is expected to increase India’s total internet user base to 829 million by 2021 from 636.73 million in FY19. India’s internet economy is expected to double from $ 125 billion as of April 2017 to $ 250 billion by 2020, backed primarily by E-commerce. India’s E-commerce revenue is expected to jump from $ 39 billion in 2017 to $ 120 billion in 2020, growing at an annual rate of 51 %, the highest in the world.

Smartphone shipments in India increased eight % y-o-y to reach 152.5 million units in 2019, thereby making it the fastest among the top 20 smartphone markets in the world. Internet penetration in India grew from just 4 % in 2007 to 52.08 % in 2019, registering a CAGR of 24 % between 2007 and 2019. The number of internet users in India is expected to increase from 687.62 million as of September 2019 to 829 million by 2021.

Cashless transaction is perhaps the most influencing factor for the growth of ecommerce in India as both the buyers as well as sellers find it the easiest way to do business. In March 2019, debit card swipes on point of sales (PoS) stood at 407 million while debit card payments for merchant transactions have gone up more than 250% between March 2019 and 2016. This clearly reflects that people are getting comfortable with using debit cards for activities other than withdrawals at ATM. Similarly Unified Payments Interface (UPI) recorded 1.25 billion transactions in March 2020, valued at Rs 2.18 lakh crore ($ 30.97 billion).

At present, almost all ecommerce players, irrespective of sizes, do offer digital transaction of all sorts – netbanking, credit/debit card, mobile wallets and UPI. This helps in customers’ buying process and ultimately brings growth in the number of transactions.

Besides these major factors, the other complementing factors that are helping the Indian ecommerce market gaining steam include internet content in local languages; expansion of online retailers to cities beyond metros; growth of logistics and warehouses; and increasing investment in the sector.

Besides catering to customers’ needs, there have many initiatives by the Government as well as private players to address the needs of business buyers. In 2019, Amazon has launched an online Business-to-Business (B2B) marketplace in India where small and medium enterprises (SMEs) can buy products. DesiClik, a US based company, entered into strategic partnership with Indian Gifts Portal (IGP) to offer a range of B2B solutions.

Government initiatives

Besides the private sector, it has been observed that the Government has brought out many policies in the last 5 years or since 2014, that has directly impacted the growth of ecommerce in India. For example, initiatives like Digital India, Make in India, Start-up India, Skill India and Innovation Fund. The timely and effective implementation of such programs will likely support growth of E-commerce in the country. Some of the major initiatives taken by the Government to promote E-commerce in India are as follows:

Besides the private sector, it has been observed that the Government has brought out many policies in the last 5 years or since 2014, that has directly impacted the growth of ecommerce in India. For example, initiatives like Digital India, Make in India, Start-up India, Skill India and Innovation Fund. The timely and effective implementation of such programs will likely support growth of E-commerce in the country. Some of the major initiatives taken by the Government to promote E-commerce in India are as follows:

• Government e-Marketplace (GeM) signed a Memorandum of Understanding (MoU) with Union Bank of India to facilitate a cashless, paperless and transparent payment system for an array of services in October 2019. The Government e-marketplace (GeM), three years after its inauguration, saw a cumulative procurement by central and state Governments of Rs 24,183 crore ($ 3.46 billion) in FY19 and has a target of Rs 50,000 ($ 7.15 billion) crore in FY20.

• In February 2019, the Government of India released the Draft National e-Commerce Policy which encourages FDI in the marketplace model of E-commerce

• In order to increase the participation of foreign players in E-commerce, Indian Government hiked the limit of FDI in E-commerce marketplace model to up to 100 % (in B2B models).

• Heavy investment made by the Government in rolling out fiber network for 5G will help boost E-commerce in India.

• In Union Budget of 2018-19, Government allocated Rs 8,000 crore ($ 1.24 billion) to BharatNet Project to provide broadband services to 150,000-gram panchayats

• As of August 2018, the Government has been working on the second draft of E-commerce policy, incorporating inputs from various industry stakeholders.

• Udaan, a B2B online trade platform that connects small and medium size manufacturers and wholesalers with online retailers and provide them logistics, payments and technology support, has sellers in over 80 Indian cities and delivers to over 500 cities.

Major Developments

Some of the major developments in the Indian e-commerce sector are as follows:

• Reliance Retail is going to launch online retail. It already launched its food and grocery app for beta testing among its employees in 2019. Reliance will invest Rs 20,0000 crore ($ 2.86 billion) in its telecom business to expand its broadband and E-commerce presence and to offer 5G services.

• In August 2019, Amazon acquired 49 % stake in a unit of Future Group.

• In September 2019, PhonePe launched super-app platform ‘Switch’ to provide a one stop solution for customers integrating several other merchants apps.

• In November 2019, Nykaa opened its 55th offline store marking success in tier II and tier III cities.

• Flipkart, India’s largest E-commerce entity, announced the launch of its data centre in Hyderabad besides investment in the state to strengthen its existing technology infrastructure.

• In January 2020, Divine Solitaires launched its E-commerce platform.

• In February 2020, Flipkart set up a ‘Furniture Experience Center’ in Kolkata, its first offline presence in eastern India.

• In April 2020, Reliance Industries (RIL) started home delivery of essentials in partnership with local kirana stores in Navi Mumbai, Thane and Kalyan.

• In May 2020, PepsiCo India partnered with Dunzo for its snack food brands that include Lay’s, Kurkure, Doritos and Quaker.

• In May 2020, chocolate maker Hershey India partnered with Swiggy and Dunzo to launch their flagship online store in order to increase reach.

• In April 2020, Swiggy received an additional $ 43 million funding as part of its ongoing Series I round.

Outlook

The year 2020-21 would see a lot changes in businesses of all kind on account of Covid-19 and the resultant outcomes. Customers would remain wary of visiting physical stores and would prefer shopping over virtual platforms. This is going to fuel the growth of ecommerce in India. Also, to maintain business continuity amid Covid-induced restrictions including social distancing, business houses will tend to adopt IT solutions at a much higher pace compared to previous years which would ultimately fuel the growth of the ecommerce industry. Technology enabled innovations like digital payments, hyper-local logistics, analytics driven customer engagement and digital advertisements will likely support the growth in the sector. The growth in E-commerce sector will also boost employment, increase revenues from export, increase tax collection by ex-chequers, and provide better products and services to customers in the long-term.

Happiest Minds brings in an innovative GenAI chatbot

Happiest Minds Technologies has announced the new GenAI chatbot - ‘hAPPI...

Government mandates encryption for CCTV cameras to ensure netw

In the wake of issuing an internal advisory on securing CCTV cameras at g...

TRAI recommends allowing only Indian entities to participate i

The Telecom Regulatory Authority of India (TRAI) has recommended that onl...

Galaxy AI is available on more devices with Samsung One UI 6.1

Samsung has expanded the range of smartphones to which One UI 6.1 and Gala...

Technology Icons Of India 2023: Sridhar Vembu

Sridhar Vembu is an Indian billionaire business magnate and the Founde...

Technology Icons Of India 2023: Sunil Bharti Mittal

Sunil Bharti Mittal is the Founder and Chairman of Bharti Enterprises,...

Technology Icons Of India 2023: Deepinder Goyal

Deepinder Goyal is the Founder and CEO of Zomato. Deepinder, or Deepi,...

CERT-IN protecting the cyber security space of India

CERT-In serves in the area of cyber security threats like hacking and ...

NIC bridging the digital divide and supporting government in eGovernance

The National Informatics Centre (NIC) is an Indian government departme...

DRDO is India's largest and most diverse research organisation

DRDO is the R&D wing of Ministry of Defence, Govt of India, with a vis...

Crayon Software Experts India Pvt Ltd

Crayon helps its customers build the commercial and technical foundati...

SUPERTRON ELECTRONICS PVT. LTD.

Supertron deals in servers, laptops, components, accessories and is a...

TECH DATA, A TD SYNNEX COMPANY

Tech Data Corporation was an American multinational distribution compa...