Infosys promoters, holding 13.05% of the company’s equity, including families of co-founders Narayana Murthy and Nandan Nilekani, have opted out of the buyback, signaling confidence in the company and boosting retail investors’ entitlement ratios

Shares of IT giant Infosys surged 4% on October 23 after the company’s promoters and promoter group, including Nandan Nilekani and Sudha Murty, announced they would not participate in the firm’s largest-ever share buyback of Rs 18,000 crore. At 10:05 am, the stock was trading at Rs 1,533, making it the top gainer on the Nifty index, while the Nifty IT index rose 2.4%, leading sectoral gains.

Infosys promoters collectively hold 13.05% of the company’s equity. “The promoters' decision to opt out of the buyback signals confidence in future prospects and improves the entitlement ratio for retail investors,” said Saurabh Jain, assistant vice president of retail equities at SMC Global. Promoters include co-founder N R Narayana Murthy’s family members Sudha Murty, Akshata Murty, and Rohan Murty as well as Nandan Nilekani’s family and other co-founders’ families.

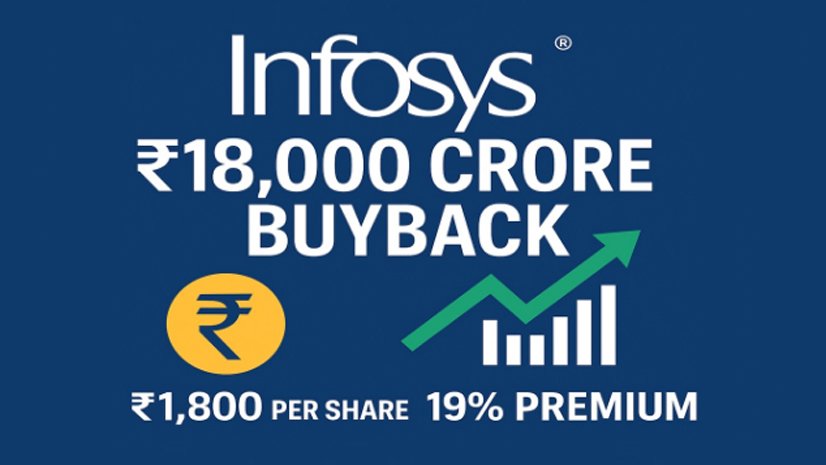

Details of the buyback program

Approved by the board on September 11, 2025, the buyback involves purchasing 10 crore fully paid-up equity shares of Rs 5 each, representing up to 2.41% of the total paid-up capital, at Rs 1,800 per share. The buyback aligns with Infosys’ capital allocation policy, which aims to return around 85% of free cash flow cumulatively over five years through dividends and share buybacks, subject to approvals. The company intends to gradually increase its annual dividend per share, with the buyback expected to enhance shareholder value over the long term by reducing the equity base.

Historical context of Infosys buybacks

Infosys has conducted several buybacks in the past. Its first share buyback in 2017 involved purchasing 11.3 crore shares for about Rs 13,000 crore. Subsequent buybacks in 2019 and 2022 were worth Rs 8,260 crore, Rs 9,200 crore, and Rs 9,300 crore respectively. The current Rs 18,000 crore program marks the largest in the company’s history.

The promoter group communicated their decision not to participate through letters dated between September 14 and September 19, 2025. As a result, voting rights of the promoter group may change depending on public participation in the buyback. Analysts suggest that the move boosts opportunities for retail investors and signals strong confidence from the company’s leadership.